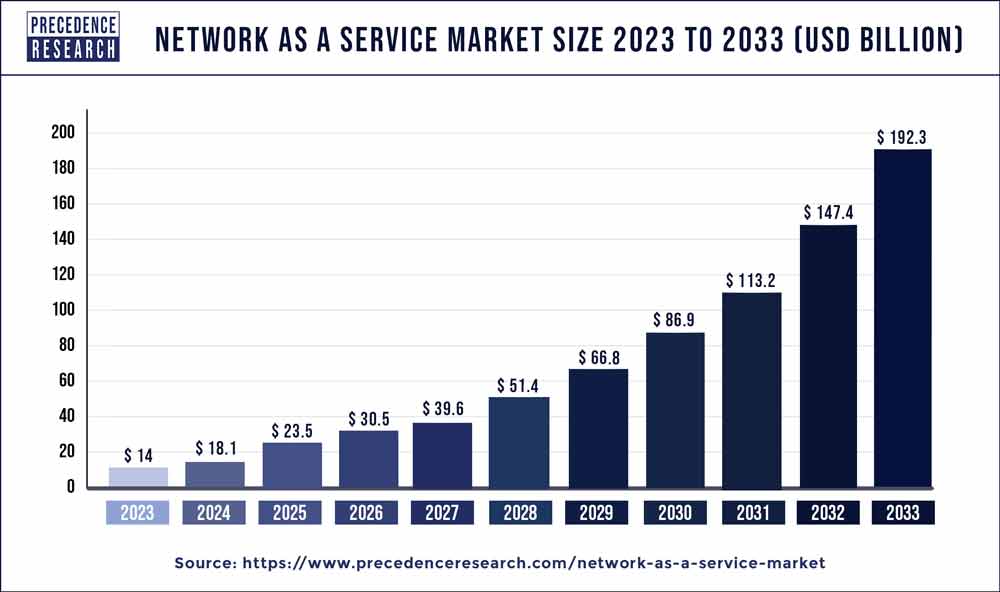

The global network as a service market size was valued at USD 14 billion in 2023 and is projected to hit around USD 192.3 billion by 2033, growing at a CAGR of 30% from 2024 to 2033.

Key Points

- North America contributed 42% of the share in the network as a service market in 2023.

- Asia-Pacific is estimated to expand the fastest CAGR between 2024 and 2033.

- By type, the WAN as a service segment held the largest market share of 53% in 2023.

- By type, the LAN as a service segment is anticipated to grow at a remarkable CAGR of 18.7% between 2024 and 2033.

- By enterprise type, the large enterprise segment generated over 56% of the market share in 2023.

- By enterprise type, the small and medium-sized enterprise segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the corporate customers segment generated over 59% of the market share in 2023.

- By end-user, the individual customers segment is expected to expand at the fastest CAGR over the projected period.

Introduction:

The rapid evolution of technology has given rise to dynamic paradigms in the business landscape, and one such transformative trend is the advent of Network as a Service (NaaS). In an era marked by digitalization and connectivity, organizations are increasingly recognizing the significance of flexible, scalable, and efficient networking solutions. Network as a Service encapsulates the concept of delivering network services over the internet, providing a cloud-based alternative to traditional networking infrastructure. This paradigm shift brings forth a myriad of opportunities and challenges, shaping the landscape for businesses seeking to optimize their network architecture.

Growth Factors

The Network as a Service market is propelled by a confluence of factors fostering its robust growth. Firstly, the escalating demand for scalable and on-demand networking solutions has been a pivotal driver. NaaS allows businesses to scale their network infrastructure according to dynamic requirements, offering cost-effective solutions that adapt to the evolving needs of the enterprise. Additionally, the rise of remote work and the global dispersion of workforces have accentuated the need for agile and accessible networking, further fueling the adoption of NaaS.

Moreover, the increasing complexity of traditional networking architectures and the need for simplified, centralized management have boosted the popularity of NaaS. The ability to manage and monitor network resources through a centralized platform enhances efficiency, reduces operational costs, and ensures a more streamlined approach to network management.

Network as a Service Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 30% |

| Global Market Size in 2023 | USD 14 Billion |

| Global Market Size by 2033 | USD 192.3 Billion |

| U.S. Market Size in 2023 | USD 4.12 Billion |

| U.S. Market Size by 2033 | USD 57 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Enterprise Type, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Network as a Service Market Dynamics

Drivers:

Several drivers underpinning the growth of the Network as a Service market include the proliferation of cloud computing. The synergy between NaaS and cloud services is pivotal, as organizations increasingly leverage cloud infrastructure for their operations. NaaS complements cloud computing by offering a flexible and scalable networking layer, aligning seamlessly with the agile nature of cloud-based services. This synergy enhances overall operational efficiency and facilitates the deployment of applications across distributed environments.

Furthermore, the ongoing advancements in software-defined networking (SDN) contribute significantly to the NaaS market’s expansion. SDN technologies empower organizations to abstract network control from physical devices, enabling programmable and dynamic network management. This not only enhances agility but also aligns perfectly with the core principles of NaaS, fostering a more adaptable and responsive network infrastructure.

Restraints:

Despite the promising trajectory, the Network as a Service market encounters certain challenges that act as impediments to its unhindered growth. One notable restraint is the concerns regarding data security and privacy. As organizations increasingly rely on external service providers for their network infrastructure, there is a growing apprehension about the potential vulnerabilities and risks associated with data transmission over third-party networks. Addressing these concerns becomes imperative for widespread adoption, requiring robust security protocols and compliance measures.

Additionally, the inertia of legacy systems and traditional networking approaches presents a hurdle to the seamless integration of NaaS. Many organizations are entrenched in legacy infrastructures, making the transition to NaaS a complex and gradual process. Overcoming this inertia requires strategic planning, investment, and a comprehensive change management approach.

Opportunities:

The Network as a Service market unfolds a plethora of opportunities for both service providers and businesses aiming to enhance their networking capabilities. One significant opportunity lies in the realm of 5G technology integration. As 5G networks become more prevalent, NaaS providers can capitalize on the increased bandwidth and low-latency features of 5G to deliver high-performance, next-generation networking solutions. This convergence opens avenues for innovative applications and services, ranging from augmented reality (AR) to Internet of Things (IoT) deployments.

Moreover, the growing trend of edge computing presents an opportune landscape for NaaS providers. Edge computing, characterized by decentralized processing closer to the data source, aligns seamlessly with the distributed nature of NaaS. By offering network services at the edge, NaaS providers can cater to the burgeoning demand for low-latency and high-throughput applications, such as real-time analytics and IoT devices.

Read Also: AI Camera Market Size to Reach USD 67.41 Billion by 2033

Recent Developments

- In June of 2022, the collaboration between Ericsson and Orange Egypt reached a milestone as they successfully finalized the consolidation, upgrade, and modernization of Orange Egypt’s mediation system. This advancement empowered Ericsson to efficiently filter out irrelevant data and transform it into the required format for data consumers.

- In May 2022, Huawei and Emirates formalized an agreement that encompasses collaborative marketing efforts on joint projects and promotional activities. The primary focus of this collaboration is to extend their influence in each other’s domestic markets.

- February 2022 witnessed a joint initiative by Nokia and AT&T, as they worked together to develop an RIC (RAN Intelligent Controller) software platform. Successful trials were conducted with external applications, referred to as “xApps,” at the edge of AT&T’s operational 5G mmWave network on an Open Cloud Platform. Nokia and AT&T are committed to enhancing the 5G uplink through the implementation of distributed massive MIMO technology.

Open RAN Market Companies

- Mavenir

- Altiostar

- Parallel Wireless

- Radisys

- NEC Corporation

- Qualcomm

- Samsung

- Airspan Networks

- Fujitsu

- NEC Corporation

- Cisco

- Nokia

- Intel Corporation

- ZTE Corporation

- VMware

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Unit

- Radio Unit

- Distributed Unit

- Centralized Unit

By Deployment

- Private

- Hybrid Cloud

- Public Cloud

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/