- Asia-Pacific held the largest share of 51% in 2023.

- North America is expected to grow at a CAGR of 25.1% during the forecast period.

- By technology, the non-volatile memory segment held the largest share of 76% in 2023.

- By wafer size, the 300mm segment held the largest share of 61% of the market in 2023.

- By wafer size, the 200mm segment is expected to grow at a significant rate during the forecast period.

- By application, the BFSI segment held the largest share of the market by contributing 32% in 2023.

The Next Generation Memory market has witnessed substantial growth in recent years, fueled by advancements in technology and the increasing demand for high-performance memory solutions across various industries. Next Generation Memory refers to a class of non-volatile memory technologies that promise improved speed, endurance, and energy efficiency compared to traditional memory solutions. This market encompasses a diverse range of technologies, including Resistive RAM (ReRAM), Magnetic RAM (MRAM), and 3D XPoint, among others.

One of the key driving factors behind the growth of the Next Generation Memory market is the escalating demand for faster and more reliable memory solutions in applications such as data centers, artificial intelligence (AI), and Internet of Things (IoT) devices. As these technologies continue to evolve and become integral parts of our daily lives, the need for efficient and high-capacity memory becomes paramount.

Get a Sample: https://www.precedenceresearch.com/sample/3747

Growth Factors

Several factors contribute to the positive trajectory of the Next Generation Memory market. The relentless pursuit of faster and more energy-efficient computing solutions is a significant driver. Next Generation Memory technologies offer a compelling solution by providing higher data transfer rates and lower power consumption compared to conventional memory solutions. This makes them ideal for applications where speed and energy efficiency are critical, such as in-memory databases and real-time analytics.

Moreover, the increasing adoption of emerging technologies like 5G, edge computing, and artificial intelligence has created a surge in data processing requirements. Next Generation Memory addresses these needs by providing the necessary speed and responsiveness to handle vast amounts of data quickly and efficiently. The scalability of these memory technologies further positions them as key enablers for the evolving digital landscape.

Next Generation Memory Market Scope

| Report Coverage | Details |

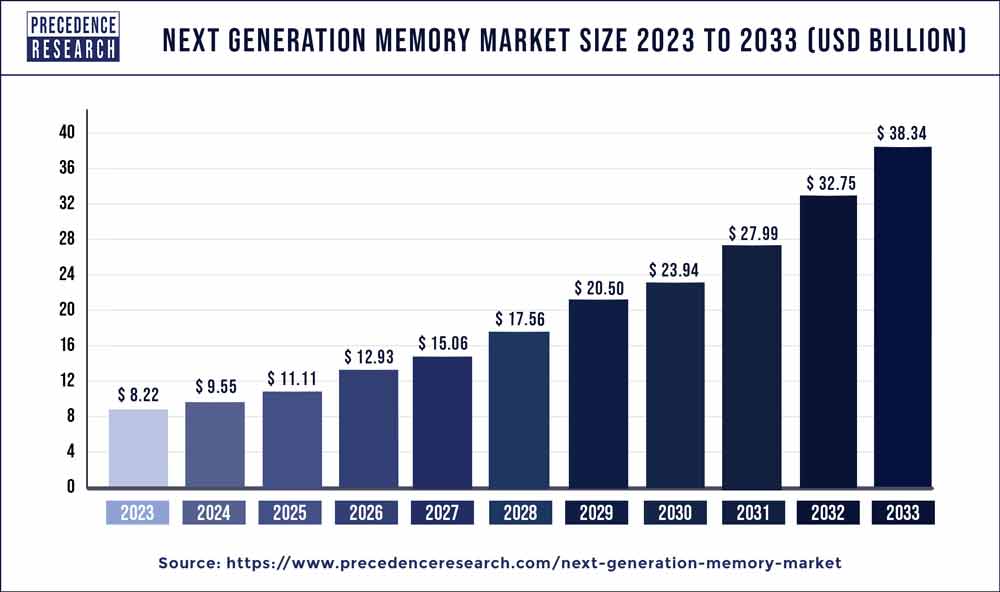

| Growth Rate from 2024 to 2033 | CAGR of 16.70% |

| Global Market Size in 2023 | USD 8.22 Billion |

| Global Market Size by 2033 | USD 38.34 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Technology, By Wafer Size, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In April 2023, SK Hynix Inc. of South Korea achieved a significant industry milestone by developing a 12-layer HBM31 product with a memory capacity of 24 gigabytes (GB), marking the largest capacity in the industry. This achievement represented a 50% increase in memory capacity compared to the previous product, following the company’s mass production of the world’s first HBM3 in June 2022.

- In May 2022, Everspin Technologies Inc. based in the United States introduced the STT-MRAM EMxxLX xSPI Family, featuring densities ranging from 8 Mbit up to 64 Mbit.

- In March 2022, Fujitsu Semiconductor Memory Solution Limited in Japan launched a 12Mbit ReRAM (Resistive Random Access Memory) known as MB85AS12MT, representing the highest density in Fujitsu’s ReRAM product family. The MB85AS12MT is a non-volatile memory with a 12Mbit memory density and operates within a wide power supply voltage range from 1.6V to 3.6V.

Next Generation Memory Market Dynamics

Drivers

The Next Generation Memory market is primarily driven by the growing demand for faster and more reliable memory solutions across diverse industries. The proliferation of data-intensive applications, such as high-performance computing, autonomous vehicles, and advanced gaming, is pushing the boundaries of traditional memory technologies. Next Generation Memory technologies offer a leap forward in terms of speed and efficiency, making them essential for meeting the performance demands of these applications.

Additionally, the increasing focus on data-centric applications in areas like artificial intelligence and machine learning is propelling the demand for memory solutions capable of handling large datasets efficiently. Next Generation Memory’s ability to deliver high-speed data access and low latency positions it as a crucial component in the architecture of advanced computing systems.

Restraints

While the Next Generation Memory market shows immense promise, it is not without challenges. One significant restraint is the cost associated with the development and manufacturing of these advanced memory technologies. The research and development efforts required to bring Next Generation Memory to market, coupled with the complexities of fabrication processes, contribute to higher production costs compared to traditional memory solutions.

Moreover, interoperability issues and the need for industry-wide standards pose challenges to the widespread adoption of Next Generation Memory. As different technologies vie for dominance in the market, ensuring compatibility and seamless integration with existing systems becomes a critical concern for businesses and manufacturers.

Opportunities

Despite the challenges, the Next Generation Memory market presents lucrative opportunities for innovation and growth. The increasing demand for high-performance memory in emerging technologies like quantum computing and neuromorphic computing opens new avenues for Next Generation Memory technologies. These applications require memory solutions that can keep pace with the unique computational requirements of these cutting-edge technologies, providing an opportunity for market players to establish themselves as key contributors to the future of computing.

Furthermore, as the Internet of Things (IoT) ecosystem continues to expand, the need for efficient and reliable memory in edge devices becomes paramount. Next Generation Memory, with its combination of speed and energy efficiency, is well-positioned to cater to the evolving requirements of edge computing, creating opportunities for market players to tap into this growing segment.

Read Also: AI in Food Market Size, Trends, Opportunitis, Report by 2033

Next Generation Memory Market Companies

- Micron Technology, Inc. (United States)

- Samsung Electronics Co., Ltd. (South Korea)

- SK Hynix Inc. (South Korea)

- Intel Corporation (United States)

- Western Digital Corporation (United States)

- Toshiba Memory Corporation (Japan)

- Fujitsu Ltd. (Japan)

- Adesto Technologies Corporation (United States)

- Crossbar Inc. (United States)

- Everspin Technologies Inc. (United States)

- Viking Technology (United States)

- Avalanche Technology Inc. (United States)

- Spin Memory Inc. (United States)

- Nantero Inc. (United States)

- Cypress Semiconductor Corporation (United States

Segments Covered in the Report

By Technology

- Non-volatile Memory

- Volatile Memory

By Wafer Size

- 200 mm

- 300 mm

By Application

- Consumer Electronics

- Enterprise Storage

- Automotive & Transportation

- Military & Aerospace

- Industrial

- Telecommunications

- Energy & Power

- Healthcare

- Agricultural

- Retail

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/