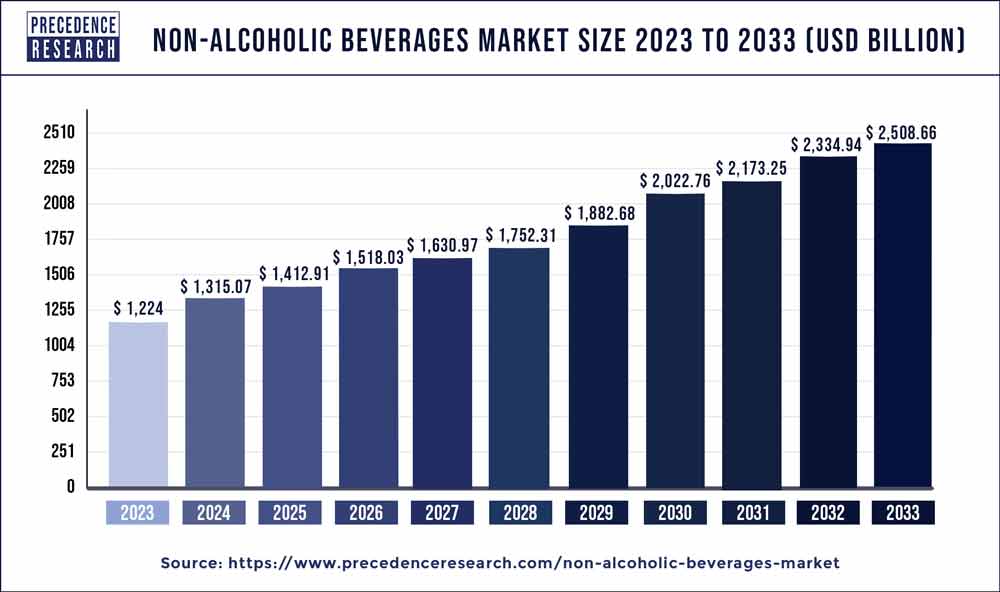

The global non-alcoholic beverages market size was valued at USD 1,224 billion in 2023 and is projected to reach around USD 2,508.66 billion by 2033, growing at a CAGR of 7.44% from 2024 to 2033.

Key Points

- North America held the largest share of the market in 2023.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2024-2033.

- By product, the functional beverages segment held the largest share of the market in 2023.

- By product, the sparkling water and seltzers segment is expected to show the fastest growth.

- By distribution, the online platforms segment held the dominating share of the market in 2023.

- By distribution, the direct-to-consumer channels segment represents another highly influential segment for the forecast period.

- By end-user, the health-conscious consumer segment held the dominating share of the market in 2023.

- By end-user, the fitness enthusiasts segment is expected to witness a significant rate of expansion during the forecast period.

The non-alcoholic beverages market is experiencing significant growth globally, driven by changing consumer preferences towards healthier lifestyles and increasing awareness about the harmful effects of excessive alcohol consumption. Non-alcoholic beverages encompass a wide range of products, including soft drinks, juices, bottled water, energy drinks, and functional beverages. This market segment caters to a diverse consumer base, ranging from health-conscious individuals seeking alternatives to sugary sodas to athletes looking for performance-enhancing beverages. The demand for non-alcoholic beverages is also being fueled by the rising trend of mindful drinking, where consumers are opting for alcohol-free alternatives during social gatherings and events.

Get a Sample: https://www.precedenceresearch.com/sample/3858

Table of Contents

ToggleGrowth Factors

Several factors contribute to the growth of the non-alcoholic beverages market. One of the primary drivers is the increasing health consciousness among consumers, leading to a growing demand for beverages perceived as healthier options. This trend has propelled the sales of natural and organic beverages, as well as those fortified with vitamins, minerals, and other functional ingredients. Additionally, the expansion of distribution channels, such as e-commerce platforms and convenience stores, has made non-alcoholic beverages more accessible to consumers, driving market growth. Furthermore, the growing influence of social media and digital marketing strategies has helped companies effectively target and engage with their consumer base, thereby boosting sales and brand awareness.

Non-Alcoholic Beverages Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.44% |

| Global Market Size in 2023 | USD 1,224 Billion |

| Global Market Size by 2033 | USD 2,508.66 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Distribution, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Non-Alcoholic Beverages Market Dynamics

Drivers:

Several drivers are propelling the growth of the non-alcoholic beverages market. Firstly, the increasing prevalence of health-conscious lifestyles has led consumers to seek alternatives to traditional sugary sodas and alcoholic beverages. This has driven the demand for healthier options such as natural juices, flavored water, and functional beverages fortified with vitamins and minerals. Additionally, the rise of wellness trends, including clean eating and mindful consumption, has further fueled the demand for non-alcoholic beverages perceived as beneficial to overall health and well-being. Furthermore, the expansion of distribution channels, including online platforms and convenience stores, has made non-alcoholic beverages more accessible to consumers, contributing to market growth.

Opportunities:

The non-alcoholic beverages market presents several opportunities for growth and innovation. One such opportunity lies in catering to niche consumer segments, such as individuals with specific dietary requirements or preferences, including vegan, gluten-free, or lactose-intolerant consumers. Developing innovative formulations and flavors to meet the diverse preferences of consumers can also open up new avenues for market expansion. Moreover, there is an opportunity for companies to capitalize on the growing demand for functional beverages that offer additional health benefits, such as improved hydration, energy enhancement, or stress relief. Investing in sustainable packaging solutions and reducing the environmental footprint of products can also position companies favorably in the market, appealing to environmentally conscious consumers.

Restraints:

Despite the growth prospects, the non-alcoholic beverages market faces certain restraints that may hinder its expansion. One significant challenge is the increasing scrutiny of sugary beverages and their association with health issues such as obesity and diabetes. This has led to regulatory measures and taxation aimed at reducing the consumption of sugary drinks, which could impact sales within this category. Additionally, the competition from other beverage categories, such as alcoholic beverages and ready-to-drink teas and coffees, poses a challenge to market growth. Economic uncertainties, fluctuations in raw material prices, and supply chain disruptions can also hinder the growth of the non-alcoholic beverages market, requiring companies to adopt strategies for mitigating risks and maintaining profitability.

Read Also: Cloud Data Center Market Size Will be USD 69.45 Billion by 2033

Recent Developments

- In January 2024, Svami unveiled two new non-alcoholic beverages. 2 Cal Cola offers a sugar-free, keto-friendly option, while Svami Salted Lemonade provides a refreshing twist with low sugar and natural lemons.

- In January 2023, AB InBev Brands reported double-digit growth in their no-alcohol beverage range, targeting diverse consumer needs. Fusion, an energy drink, seamlessly integrates into lifestyles, offering refreshment, energy, and hydration.

Competitive Landscape:

The non-alcoholic beverages market is highly competitive, with numerous global and regional players vying for market share. Major multinational corporations such as The Coca-Cola Company, PepsiCo, and Nestlé dominate the market, leveraging their extensive distribution networks, strong brand presence, and diverse product portfolios to maintain a competitive edge. These companies continuously innovate and launch new products to cater to changing consumer preferences and stay ahead of competitors. Additionally, there is a growing presence of smaller, niche players offering artisanal and craft beverages, targeting specific consumer segments with unique flavors and formulations. The competitive landscape is also characterized by strategic partnerships, acquisitions, and collaborations aimed at expanding market reach and diversifying product offerings. As competition intensifies, companies are focusing on product differentiation, marketing strategies, and sustainability initiatives to maintain relevance and sustain growth in the highly dynamic non-alcoholic beverages market.

Non-Alcoholic Beverages Market Companies

- PepsiCo, Inc.

- The Coca-Cola Company

- Danone S.A.

- Nestlé S.A.

- Red Bull GmbH

Segments Covered by the Report

By Product

- Carbonated soft drinks

- Bottled water

- Fruit juices and nectars

- Functional beverages

- Sports and energy drinks

- Ready-to-drink (RTD) tea and coffee

- Dairy and dairy alternatives

- Non-alcoholic beers and wines

- Sparkling water and seltzers

- Mixers and syrups

By Distribution

- Retail Stores

- Online Platforms

- Convenience Stores

- Supermarkets

- Specialty Stores

- Food Service Outlets

- Hospitality Industry

- Direct-to-Consumer Channels

- Beverage Vending Machines

- Institutional Sales (Schools, Offices, etc.)

By End-user

- General Consumers

- Fitness Enthusiasts

- Health-conscious Individuals

- Athletes and Sports Professionals

- Children and Teens

- Pregnant Women

- Designated Drivers

- Individuals in Recovery

- Seniors

- Professionals (e.g., at work, during meetings)

- Social Gatherings and Events

- Religious and Cultural Communities

- Individuals with Dietary Restrictions

- Wellness Retreats and Spas

- Hospitality and Catering Industry

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/