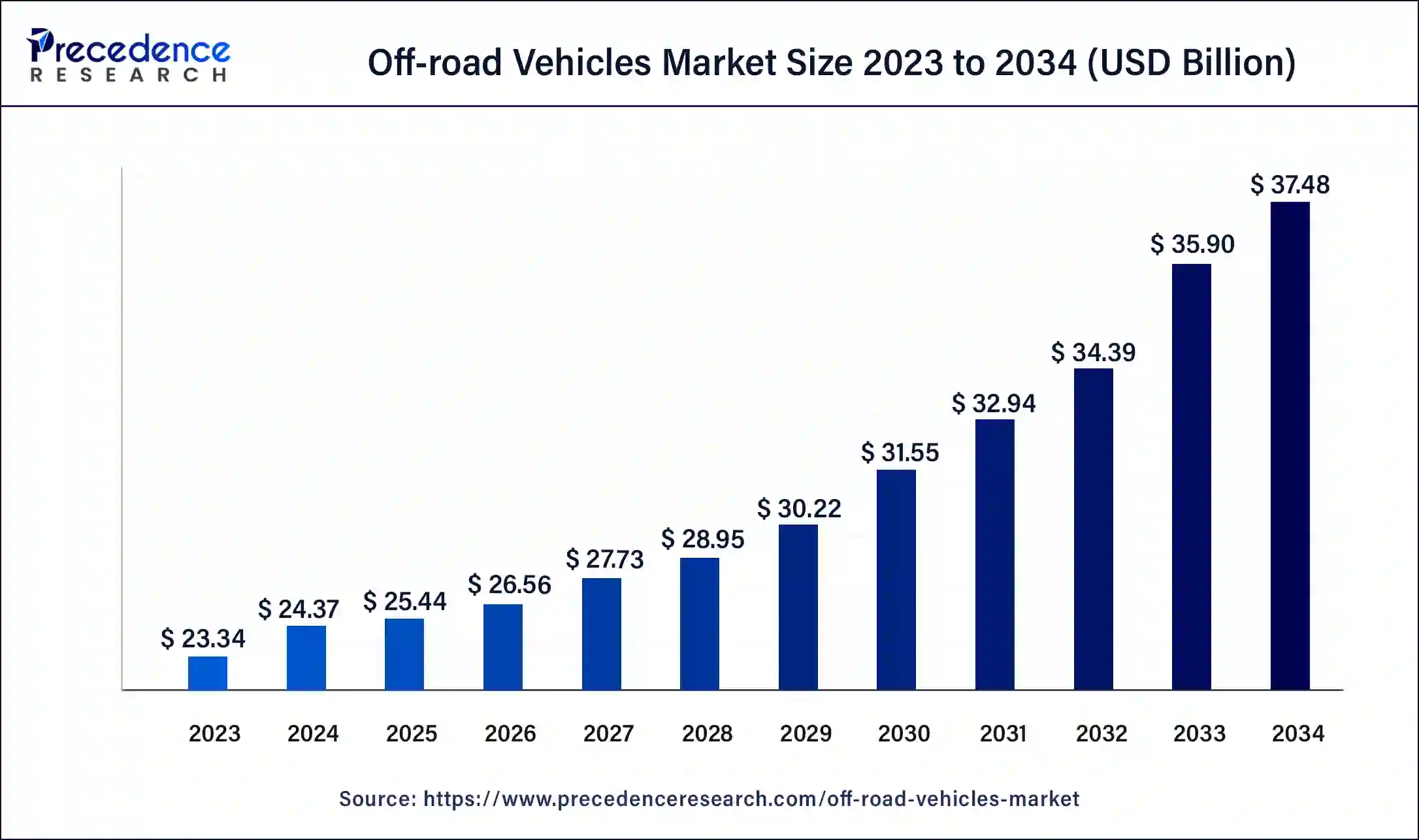

The global off-road vehicles market size accounted for USD 23.34 billion in 2023 and is anticipated to attain around USD 35.28 billion by 2033, growing at a CAGR of 4.21% from 2024 to 2033.

Key Takeaways

- North America dominated the off-road vehicles market in 2023 and accounted 66% market share.

- Asia Pacific is expected to be the significantly growing marketplace during the forecast period.

- By product type, the three-wheeler segment dominated the off-road vehicles market in 2023 and contributed 46% market share.

The off-road vehicles market encompasses a diverse range of vehicles designed for off-highway applications, including all-terrain vehicles (ATVs), utility task vehicles (UTVs), motorcycles, and other specialized vehicles. These vehicles are known for their capability to navigate rugged terrains, such as forests, mountains, and deserts. The off-road vehicles market serves various end-users, including recreational enthusiasts, farmers, construction companies, military personnel, and emergency services.

In recent years, the off-road vehicles market has experienced significant growth due to increasing outdoor recreational activities and the demand for vehicles that can handle challenging terrains. Additionally, advancements in technology have led to the development of more efficient, safe, and environmentally friendly off-road vehicles. This has further fueled market growth, making off-road vehicles more accessible and appealing to a wider audience.

Get a Sample: https://www.precedenceresearch.com/sample/4082

Growth Factors

- Rising Popularity of Outdoor Recreation: With a growing interest in outdoor activities such as camping, hiking, and trail riding, the demand for off-road vehicles has increased. People are looking for ways to explore natural landscapes, and off-road vehicles offer an excellent means to do so.

- Technological Advancements: Innovations in engine efficiency, electric powertrains, and autonomous technology have enhanced the performance and safety of off-road vehicles. These advancements attract new customers and encourage existing users to upgrade their vehicles.

- Rural and Agricultural Applications: Off-road vehicles play a crucial role in rural and agricultural settings. Farmers and landowners rely on them for tasks such as transportation, hauling, and land management.

- Military and Defense Applications: Military and defense organizations utilize off-road vehicles for their ability to navigate challenging environments. These vehicles are used for various purposes, including transport, reconnaissance, and combat support.

- Demand for Eco-friendly Vehicles: As environmental concerns rise, there is a growing demand for off-road vehicles that use alternative fuels or electric power. Manufacturers are responding by developing greener options to cater to eco-conscious consumers.

Region Insights

- North America: The North American market leads the off-road vehicles market due to a strong culture of outdoor recreation and a high standard of living. The United States and Canada have a significant number of off-road enthusiasts who actively engage in outdoor activities, driving the demand for off-road vehicles.

- Europe: In Europe, the market is driven by the popularity of off-road adventures and sports. Additionally, the adoption of electric off-road vehicles is gaining momentum due to stringent emission regulations.

- Asia-Pacific: This region is experiencing rapid growth in the off-road vehicles market, driven by an increasing middle-class population and a rising interest in outdoor activities. Countries like China, India, and Australia are major contributors to the market’s growth.

- Latin America: The Latin American market is also growing, with Brazil and Mexico leading the way. The region’s varied terrain and growing interest in off-road sports contribute to the market’s expansion.

- Middle East and Africa: Off-road vehicles are essential in the Middle East and Africa due to their ability to navigate desert and rugged terrains. The market is fueled by the region’s oil and gas industry and military applications.

Off-road Vehicles Market Scope

| Report Coverage | Details |

| Global Market Size in 2023 | USD 23.34 Billion |

| Global Market Size in 2024 | USD 24.32 Billion |

| Global Market Size by 2033 | USD 35.28 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Application, and By Propulsion Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Off-road Vehicles Market Dynamics

Drivers

- Increasing Disposable Income: As disposable income rises, people have more resources to invest in recreational activities and off-road vehicles.

- Government Initiatives and Subsidies: Some governments offer incentives for the purchase of eco-friendly off-road vehicles, which can drive market growth.

- Growing Tourism Industry: The tourism industry in many regions promotes adventure and eco-tourism, increasing the demand for off-road vehicles.

- Expanding Aftermarket Industry: The availability of aftermarket parts and accessories allows off-road vehicle owners to customize and upgrade their vehicles, enhancing their performance and lifespan.

Opportunities

- Development of Electric and Hybrid Vehicles: The growing demand for electric and hybrid off-road vehicles presents an opportunity for manufacturers to innovate and capture new markets.

- Expanding Recreational and Adventure Tourism: With more people seeking adventure and outdoor experiences, there is potential for growth in the off-road vehicles market.

- Collaboration with Technology Companies: By partnering with technology firms, off-road vehicle manufacturers can incorporate advanced features such as AI and connectivity, enhancing user experience.

- Growing Markets in Developing Regions: As emerging markets such as India and Southeast Asia continue to grow, there are opportunities for manufacturers to expand their presence.

- Focus on Safety Features: Developing off-road vehicles with enhanced safety features can attract more customers and open up new market segments.

Challenges

- Environmental Concerns: Off-road vehicles are often associated with environmental issues such as soil erosion and habitat disruption. Manufacturers need to address these concerns by developing eco-friendly alternatives.

- Regulatory Hurdles: Strict regulations on emissions and noise levels can pose challenges for manufacturers, especially in regions with stringent environmental policies.

- High Initial Costs: The cost of off-road vehicles can be a barrier for some consumers. Manufacturers need to find ways to reduce costs without compromising quality.

- Competition from Substitutes: Other recreational options such as bicycles and e-bikes may compete with off-road vehicles in certain markets.

- Market Saturation: In some regions, the market may become saturated, making it challenging for new entrants to gain a foothold.

Recent Developments

- In August 2023, BYD declared the off-road SUV BAO 5 governed by the DMO tech and FANGCHENGBAO brand.

- In August 2022, all Volcon Inc.’s off-road utility terrain vehicles, notably the company’s flagship Volcon Stag UTV, which was unveiled to the public on July 1, 2022, will be powered by General Motors’ tried and accurate electric propulsion systems. Future GM electric propulsion systems will be used in the design and development of future models, which will include further iterations of the Stag and the company’s projected “Project X” vehicle. With GM’s electric propulsion, Volcon will be the first and, for now, the sole off-road power sports manufacturer to provide their entire lineup of vehicles.

Read Also: Intragastric Balloon Market Size to Attain USD 108.80 Mn by 2033

Off-road Vehicles Market Companies

- Arctic Cat Inc. (Textron Inc.)

- ARGO

- BRP

- Deere & Company

- Electra Meccanica

- Harley-Davison, Inc.

- Honda Motor Co., Ltd.

- SSR Motorsports

- Taiga Motors Inc.

- Yamaha Motor Co., Ltd.

Segments Covered in the Report

By Product Type

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

By Application

- Utility

- Sports

- Recreation

- Military

By Propulsion Type

- Gasoline

- Diesel

- Electric

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/