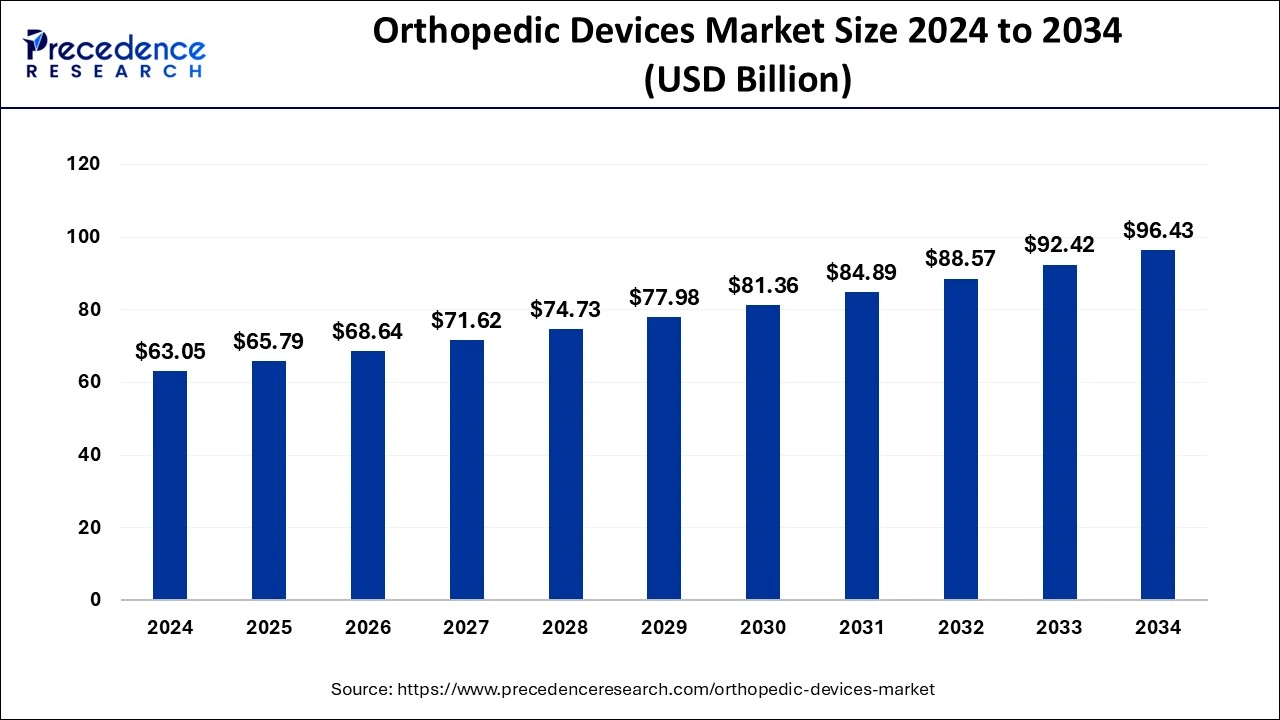

Orthopedic devices market size to reach USD 96.43 billion by 2034, expanding at a CAGR of 4.34% from USD 65.79 billion in 2024.

- North America remained the largest regional market, accounting for 46% of global orthopedic device sales in 2024, supported by a high prevalence of orthopedic disorders and favorable reimbursement policies.

- Asia Pacific is projected to register the highest growth rate from 2025 to 2034, driven by increasing access to healthcare, a growing elderly population, and a surge in orthopedic surgeries.

- Knee orthopedic devices held the largest market share by application in 2024, owing to the rising incidence of knee osteoarthritis and a growing preference for joint replacement procedures.

- The surgical devices segment led the market in 2024, reflecting advancements in orthopedic surgery techniques and a shift toward minimally invasive and robotic-assisted procedures.

Orthopedic Devices Market Overview

The Orthopedic Devices Market is growing steadily due to the increasing demand for joint replacement surgeries, spinal procedures, and trauma fixation devices. These medical devices are essential for treating a wide range of musculoskeletal conditions, from fractures and dislocations to degenerative diseases like osteoarthritis. The continuous development of minimally invasive surgical techniques and customized orthopedic implants is reshaping the industry, offering improved patient comfort and faster recovery times. The market is also benefiting from the growing awareness of orthopedic health and lifestyle changes that promote early diagnosis and treatment of bone-related disorders.

Market Drivers

The increasing incidence of osteoporosis, arthritis, and sports-related injuries is a primary driver of the orthopedic devices market. A growing geriatric population that is more susceptible to orthopedic disorders is further fueling demand for joint replacement surgeries. Technological innovations, such as 3D printing, robotic-assisted surgery, and smart implants, are enhancing the precision and longevity of orthopedic treatments. The rise in outpatient orthopedic surgeries is also contributing to market growth, as patients seek less invasive and cost-effective procedures. Additionally, the increase in road accidents has led to a higher demand for trauma fixation devices.

Opportunities

The market presents numerous opportunities, particularly in the development of biodegradable and patient-specific orthopedic implants. The integration of artificial intelligence and data analytics into orthopedic treatments is enabling personalized care and better post-surgical monitoring. The growing acceptance of orthobiologics, which use natural substances to promote bone healing, is also creating new avenues for market growth. Emerging economies in Asia, Latin America, and the Middle East are investing in healthcare infrastructure, providing manufacturers with opportunities to expand their footprint in these regions.

Challenges

The high cost of orthopedic implants and surgical procedures remains a significant challenge, limiting access to advanced treatments in developing nations. The long and complex regulatory approval process for new orthopedic devices can delay market entry for innovative products. Additionally, post-surgical complications, such as implant infections and device failures, pose risks for both patients and healthcare providers. The lack of skilled orthopedic surgeons and specialized healthcare facilities in certain regions further hinders market growth.

Regional Insights

North America remains the largest market for orthopedic devices, driven by high healthcare spending, advanced medical technologies, and a large aging population. Europe also holds a significant market share, with strong regulatory frameworks and research initiatives supporting innovation. The Asia-Pacific region is emerging as a key growth area due to rising healthcare awareness, increasing disposable income, and government investments in medical infrastructure. Countries such as China, India, and Japan are witnessing a surge in demand for orthopedic procedures, making the region highly attractive for industry players.

Recent News

Recent developments in the orthopedic devices market include the launch of next-generation knee and hip implants, offering improved mobility and durability. The use of robotic-assisted surgical systems is becoming more prevalent, enhancing the precision of orthopedic procedures. Companies are also exploring nanotechnology-based coatings for implants to reduce infection risks and improve longevity. Strategic partnerships and acquisitions among medical device companies are driving innovation and expanding product offerings in the global market.

Orthopedic Devices Market Companies

- Medacta

- DePuySynthes

- Smith & Nephew

- Stryker

- Medtronic

- Zimmer Biomet

Segments Covered in the Report

By Product Type

- Joint Reconstruction

- Knee Replacement

- Revision Knee Replacement Implants

- Total Knee Replacement Implant

- Partial Knee Replacement Implant

- Elbow & Shoulder Replacement

- Hip Replacement

- Hip Resurfacing Implant

- Total Hip Replacement Implant

- Partial Hip Replacement Implant

- Revision Hip Replacement Implant

- Others

- Knee Replacement

- Orthopedic Prosthetics

- Upper Extremity Orthopedic Prosthetics

- Lower Extremity Orthopedic Prosthetics

- Spinal Devices

- Spinal Non-fusion Devices

- Spinal Fusion Devices

- Trauma Fixation

- Nails and Rods

- Metal Plates & Screws

- Pins/Wires

- Others

- Arthroscopy Devices

- Orthopedic Accessories

- Removal systems

- Bone cement

- Casting system

- Orthopedic Braces and Supports

- Upper Extremity Braces and Supports

- Low Extremity Braces and Supports

- Others

By End-user

- Ambulatory Surgical Centers

- Hospitals

- Orthopedic Clinics

- Others

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/