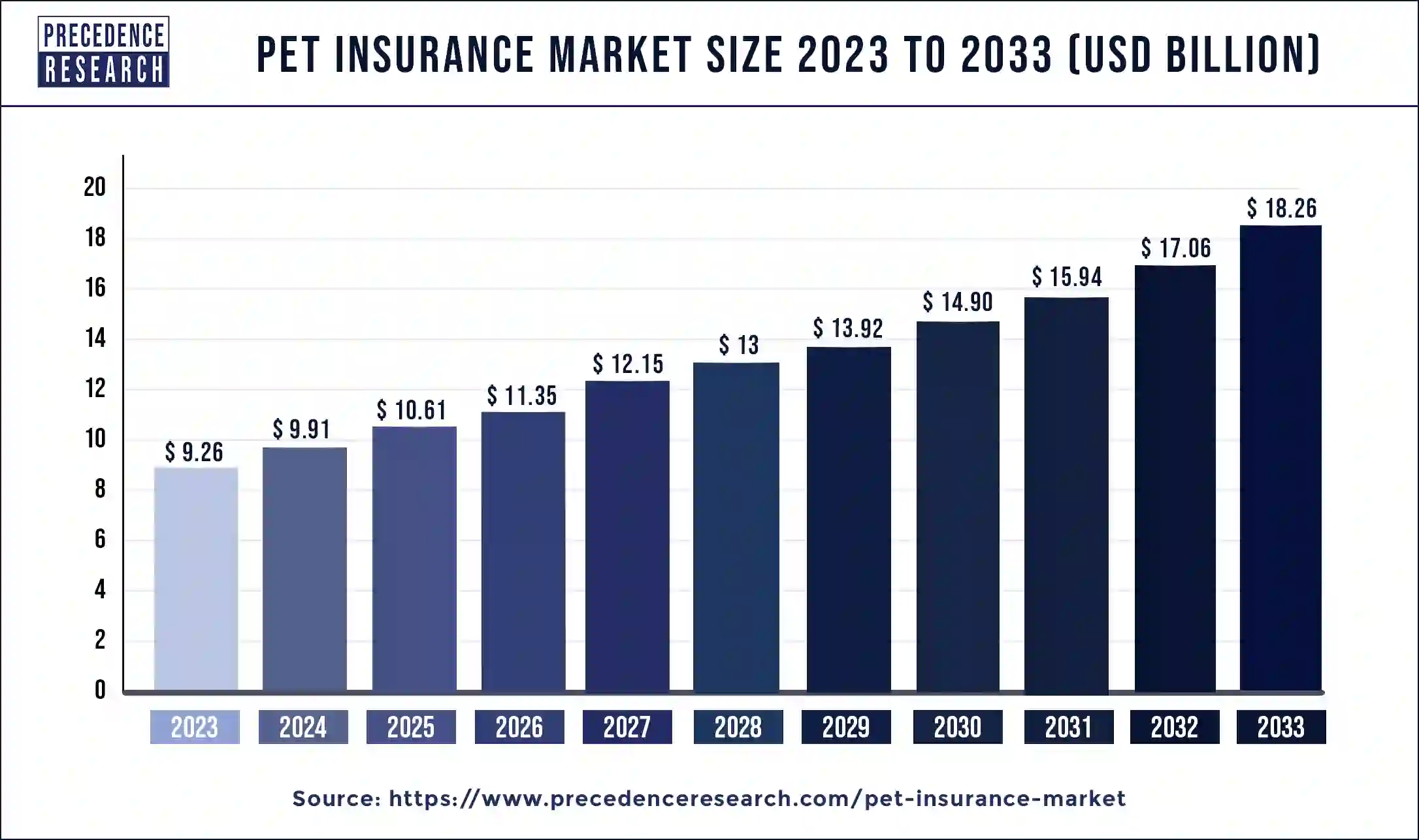

The global pet insurance market size accounted for USD 9.26 billion in 2023 and is projected to attain around USD 18.26 billion by 2033, growing at a CAGR of 7.03% from 2024 to 2033.

Key Points

- Europe dominated the global market with the largest market share of 35% in 2023.

- North America is expected to witness notable growth during the forecast period.

- By policy type, the accident & illness segment has contributed 97% of market share in 2023.

- By end-user, the dogs segment dominated the market in 2023.

- By end-user, the cats segment is expected to gain a significant share during the upcoming years.

The pet insurance market has experienced significant growth in recent years, driven by rising pet ownership, increasing awareness of veterinary care costs, and the growing importance of pets in households. Pet insurance provides financial protection to pet owners against unexpected veterinary expenses, including accidents, illnesses, and preventive care. Understanding the dynamics of the pet insurance market requires an analysis of key trends, growth factors, regional insights, drivers, opportunities, and challenges that shape its evolution.

Get a Sample: https://www.precedenceresearch.com/sample/3982

Trends:

Several trends are shaping the pet insurance market landscape. One prominent trend is the increasing humanization of pets, with owners viewing their pets as family members and seeking comprehensive healthcare coverage for them. This trend has led to a surge in demand for pet insurance policies that offer extensive coverage options, including wellness benefits, alternative therapies, and even coverage for holistic treatments. Additionally, technological advancements, such as mobile apps and digital platforms, are transforming the way pet insurance is marketed, sold, and managed, enhancing customer experience and engagement.

Growth Factors

The pet insurance market is fueled by various growth factors driving its expansion. One key factor is the growing awareness of the importance of pet health and wellness among pet owners. As veterinary costs continue to rise, pet insurance offers a practical solution to mitigate financial risks associated with unexpected medical expenses. Moreover, the increasing prevalence of chronic diseases and age-related conditions in pets underscores the need for comprehensive insurance coverage to ensure access to timely and quality healthcare services. Furthermore, favorable regulatory frameworks and partnerships between insurers, veterinarians, and pet-related businesses are facilitating market growth and innovation.

Regional Insights:

The pet insurance market exhibits regional variations influenced by factors such as pet ownership rates, cultural attitudes towards pets, and regulatory environments. In North America, particularly in the United States and Canada, the pet insurance market is well-established and highly competitive, driven by a large pet-owning population and a robust veterinary care infrastructure. In Europe, countries like the United Kingdom, Germany, and Sweden have witnessed rapid growth in pet insurance adoption, supported by increasing pet ownership and rising healthcare expenditures. Emerging markets in Asia-Pacific, including Japan, Australia, and South Korea, are experiencing growing demand for pet insurance, fueled by rising affluence, urbanization, and changing lifestyles.

Pet Insurance Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 7.03% |

| Global Market Size in 2023 | USD 9.26 Billion |

| Global Market Size by 2033 | USD 18.26 Billion |

| Largest Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Policy Type and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pet Insurance Market Dynamics

Drivers:

Several drivers are propelling the growth of the pet insurance market globally. Pet humanization, characterized by the increasing importance of pets in households and the desire to provide them with the best possible care, is a significant driver stimulating demand for insurance coverage. Additionally, advancements in veterinary medicine and technology have expanded treatment options and improved the quality of care, driving the need for insurance to cover the costs of specialized treatments and procedures. Moreover, the proliferation of pet-related services and products, including pet grooming, boarding, and daycare, further underscores the importance of insurance in safeguarding pet owners against financial risks associated with pet care.

Opportunities:

The pet insurance market presents numerous opportunities for insurers, pet-related businesses, and investors to capitalize on emerging trends and market dynamics. Expanding product offerings to include customizable insurance plans tailored to specific pet healthcare needs can attract a broader customer base and enhance competitiveness. Leveraging data analytics and digital technologies to streamline claims processing, enhance customer engagement, and personalize services can improve operational efficiency and drive customer satisfaction. Furthermore, partnerships with veterinarians, pet retailers, and e-commerce platforms can facilitate market penetration and distribution, expanding reach and market share.

Challenges:

Despite its growth potential, the pet insurance market faces several challenges that require attention and strategic mitigation. One challenge is consumer perception and understanding of pet insurance, with some pet owners perceiving it as an unnecessary expense or lacking awareness of its benefits. Educating consumers about the value proposition of pet insurance and addressing concerns about coverage limitations and exclusions are critical to increasing adoption rates. Moreover, regulatory compliance, including licensing requirements, consumer protection regulations, and underwriting standards, poses challenges for insurers operating in multiple jurisdictions. Additionally, pricing pressures, competitive dynamics, and the emergence of alternative financing options, such as pet savings accounts and crowdfunding platforms, present challenges to profitability and market differentiation.

Read Also: Joint Reconstruction Devices Market Size, Trends Report by 2033

Recent Developments

- In 2024, a leading cloud-based company called Five Sigma collaborated with Odie Pet Insurance to make pet insurance accessible and affordable in many regions. These companies aim to accelerate the pet insurance market.

- In 2023, a pet insurance platform named Independent Pet Group (IPG) partnered with Felix for the insurance of cats in the United States.

- In 2023, The global risk partners acquired Petsmedicover, a pet insurance broker in the United Kingdom.

- In 2023, a company called ‘Go Digit General Insurance’ collaborated with Vetina to offer insurance coverage, especially for dogs.

- In 2023, Best Friends Animal Society (BFAS), an animal welfare organization, partnered with Fetch to promote the shelter of dogs and cats in America. This collaboration will aim to provide a shelter for pets.

Pet Insurance Market Companies

- Animal Friends Insurance Services Limited

- Figo Pet Insurance, LLC

- Direct Line

- Nationwide Mutual Insurance Company

- Embrace Pet Insurance Agency, LLC

- Anicom Insurance

- Trupanion, Inc.

- Deutsche Familienversicherung AG (DFV)

- Petplan (Allianz)

- ipet Insurance Co., Ltd.

- MetLife Services and Solutions, LLC

- Pumpkin Insurance Services Inc.

Segments Covered by the Report

By Policy Type

- Accident

- Accident & Illness

- Embedded Wellness

By End-user

- Dogs

- Cats

- Horses

- Exotic Pets

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/