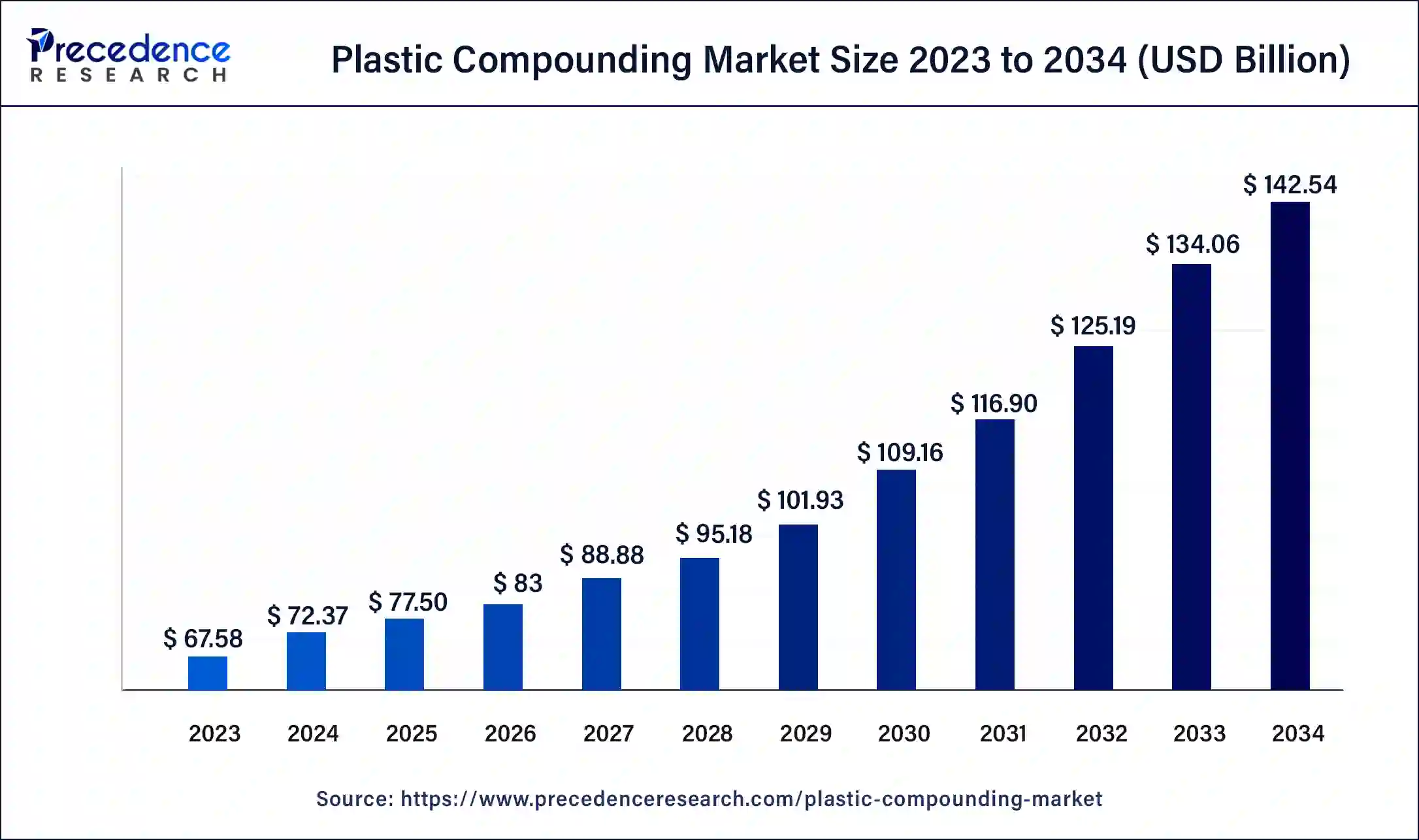

Plastic compounding market size to double by 2034, reaching USD 142.54 billion from USD 72.37 billion in 2024 at a 7% CAGR.

- Asia Pacific remained the leading region in the plastic compounding market with a 46% share in 2023.

- Automotive applications accounted for more than 26% of global revenue in 2023.

- Polypropylene (PP) was the most dominant product, securing a 33% market share in 2023.

The plastic compounding market plays a crucial role in the global materials industry, enhancing the properties of base polymers by incorporating additives like fillers, colorants, and stabilizers. This process customizes plastics to meet specific performance needs across diverse sectors, including automotive, construction, packaging, and electronics. In 2023, the market was valued at approximately USD 69.2 billion and is expected to grow to around USD 156.4 billion by 2032, with a projected compound annual growth rate (CAGR) of 9.6%.

Drivers:

Several key factors are driving the growth of the plastic compounding market. The automotive industry’s push for lightweight materials to enhance fuel efficiency and reduce emissions has increased the use of compounded plastics, known for their excellent strength-to-weight ratio. In construction, their versatility and durability make them ideal for applications like piping, insulation, and window profiles. Meanwhile, advancements in polymer technology have expanded their role in the electrical and electronics sectors, where properties such as electrical insulation and heat resistance are essential. Additionally, the packaging industry fuels market growth, benefiting from compounded plastics’ flexibility, strength, and barrier protection capabilities.

Opportunities:

The market presents significant opportunities, particularly in the development of sustainable and eco-friendly plastic compounds. Growing environmental concerns and stringent regulations are driving the demand for biodegradable, recyclable, and bio-based plastics. Companies investing in research and development to create such sustainable solutions are poised to gain a competitive advantage. Emerging applications in medical devices and renewable energy sectors also offer new avenues for growth. In healthcare, the need for biocompatible and sterilizable materials is increasing, while the renewable energy sector requires durable and weather-resistant plastics for components in solar panels and wind turbines.

Challenges:

Despite the positive outlook, the plastic compounding market faces challenges, notably the volatility of raw material prices, which can impact production costs and profit margins. The reliance on petrochemical feedstocks makes the industry susceptible to fluctuations in oil prices. Additionally, environmental concerns regarding plastic waste have led to stricter regulations, compelling manufacturers to adopt sustainable practices and develop eco-friendly products. The need for continuous innovation to meet regulatory standards and consumer expectations adds to the complexity of the market landscape.

Regional Insights:

The Asia Pacific region dominates the plastic compounding market, accounting for over 44% of the global revenue in 2023. This dominance is attributed to rapid industrialization, urbanization, and a burgeoning manufacturing sector in countries like China, India, and Japan. The automotive and electronics industries in these nations significantly contribute to the demand for compounded plastics. Europe holds a substantial market share, driven by a well-established automotive industry and a strong emphasis on sustainability and environmental regulations. North America also represents a significant portion of the market, with advancements in technology and a focus on high-performance materials across various industries.

Recent News:

In December 2023, Sirmax, an Italian plastic processor, announced plans to expand its plastic compounding operations in India, aiming for a production capacity of 20 kilotons per annum by the end of 2026. This move underscores the growing demand for compounded plastics in the Indian market. In November 2023, Borealis AG expanded its production of mechanically recycled plastic compounds, increasing its capacity to over 50 kilotons per annum through the acquisition of Rialti S.p.A., an Italian polypropylene compounder specializing in recyclates. These developments reflect the industry’s shift towards sustainability and the increasing importance of recycled materials in plastic compounding.

Plastic Compounding Market Companies

- BASF SE

- Asahi Kasei Plastics

- The Dow Chemical Company

- LyondellBasell Industries N.V.

- SABIC

Segments Covered in the Report

By Application

- Electronics & Electrical

- Automotive

- Packaging

- Building & Construction

- Industrial Machinery

- Optical Media

- Consumer Goods

- Medical Devices

- Others

By Product

- Thermoplastic Polyolefins (TPO)

- Poly Vinyl Chloride (PVC)

- Polypropylene (PP)

- Polyethylene

- Thermoplastic Vulcanizates (TPV)

- Polystyrene

- Polybutylene Terephthalate (PBT)

- Polycarbonate

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene (PET)

- Polyamide

- PA 6

- PA 66

- PA 46

- Others

By Source

- Fossil-based

- Bio-based

- Recycled

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Italy

- Asia Pacific

- China

- Japan

- India

- Latin America

- Middle East & Africa

- Saudi Arabia

- South Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/