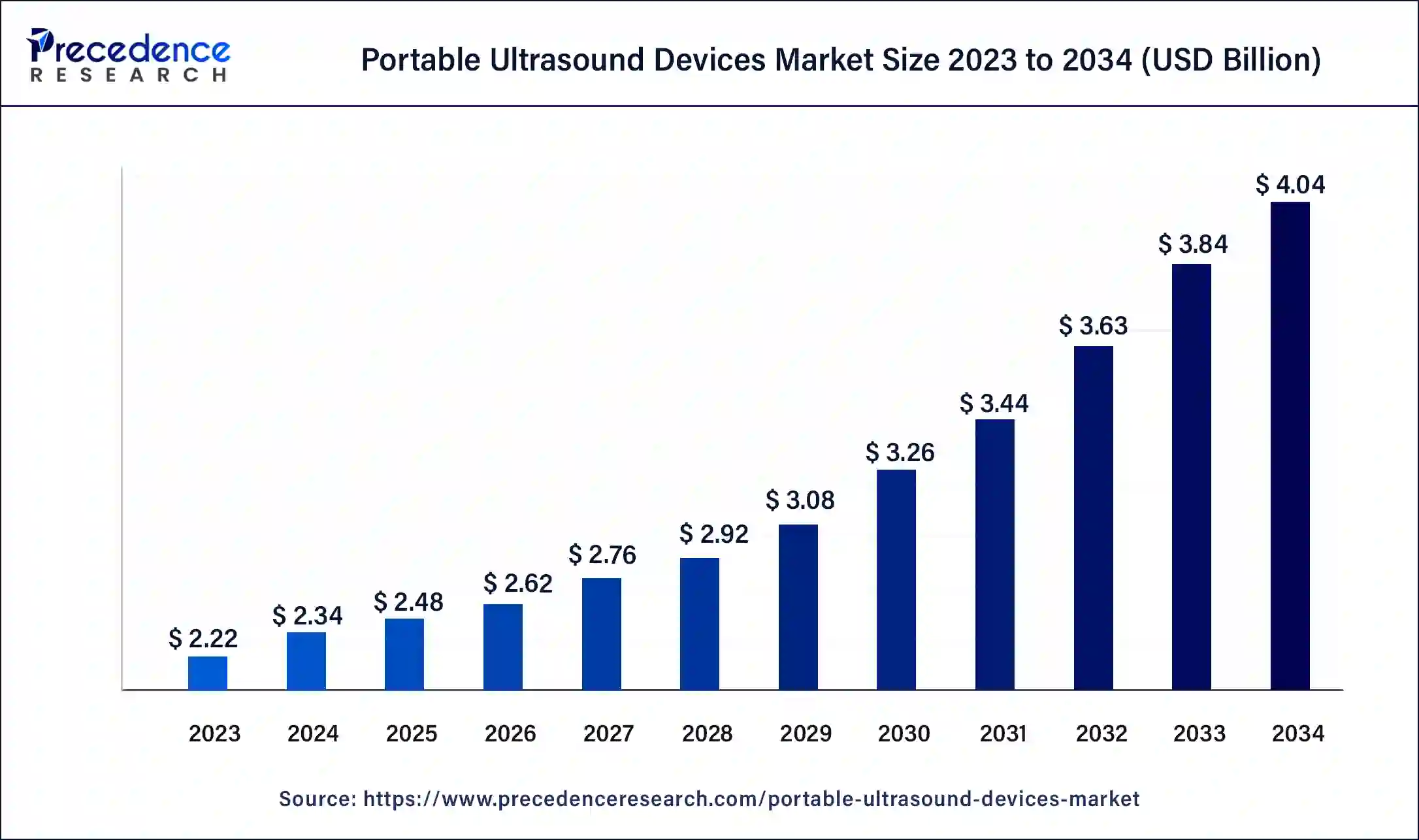

The global portable ultrasound devices market size accounted for USD 2.22 billion in 2023 and is predicted to grow around USD 3.83 billion by 2033, growing at a CAGR of 5.62% from 2024 to 2033.

Key Points

- The North America portable ultrasound devices market size accounted for USD 950 million in 2023 and is expected to attain around USD 1,670 million by 2033, poised to grow at a CAGR of 5.80% between 2024 and 2033.

- North America dominated the market with the largest revenue share of 43% in 2023.

- Asia Pacific is estimated to grow at the fastest CAGR of 6.72% during the forecast period.

- By type, the handheld segment has held the largest revenue share of 56% in 2023.

- By application, the obstetrics/gynecology segment has contributed a major revenue share of 47% in 2023.

- By application, the cardiovascular segment is estimated to expand at a solid CAGR of 7.12% during the forecast period.

- By technology, the Doppler ultrasound segment has generated more than 47% of revenue share in 2023.

- By technology, the 3D and 4D ultrasound segment is projected to grow at a notable CAGR of 8.05% during the forecast period.

- By end-use, the hospitals & clinics segment has held the maximum revenue share of 57% in 2023.

- By end-use, the homecare segment is growing at a CAGR of 7.04% during the forecast period.

The portable ultrasound devices market has witnessed substantial growth in recent years, fueled by advancements in technology, increasing demand for point-of-care diagnostics, and the expanding applications of ultrasound imaging across various medical specialties. Portable ultrasound devices offer advantages such as convenience, portability, and cost-effectiveness compared to traditional bulky ultrasound machines, making them increasingly popular among healthcare providers worldwide.

Get a Sample: https://www.precedenceresearch.com/sample/4356

Growth Factors

Several factors contribute to the growth of the portable ultrasound devices market. These include the rising prevalence of chronic diseases, such as cardiovascular disorders and cancer, which necessitate early and accurate diagnosis. Additionally, the growing adoption of telemedicine and remote healthcare services has led to an increased demand for portable imaging devices that can be used in various clinical settings, including remote and underserved areas.

Region Insights

The portable ultrasound devices market exhibits significant regional variation, with North America and Europe leading in terms of market share due to the presence of well-established healthcare infrastructure, high healthcare expenditure, and early adoption of advanced medical technologies. However, Asia-Pacific is expected to witness the fastest growth rate during the forecast period, driven by factors such as improving healthcare infrastructure, increasing healthcare spending, and rising awareness about early disease detection.

Portable Ultrasound Devices Market Scope

| Report Coverage | Details |

| Portable Ultrasound Devices Market Growth Rate | CAGR of 5.62% from 2024 to 2033 |

| Portable Ultrasound Devices Market Size in 2023 | USD 2.22 Billion |

| Portable Ultrasound Devices Market Size in 2024 | USD 2.34 Billion |

| Portable Ultrasound Devices Market Size by 2033 | USD 3.83 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Type, Application, Technology, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Portable Ultrasound Devices Market Dynamics

Drivers

Key drivers driving the growth of the portable ultrasound devices market include technological advancements leading to the development of compact and lightweight devices with improved imaging capabilities, rising demand for point-of-care diagnostics in emergency care and ambulatory settings, and initiatives by governments and healthcare organizations to promote the adoption of portable imaging technologies for better patient outcomes.

Opportunities

The portable ultrasound devices market presents several opportunities for manufacturers and stakeholders, including the expansion of product portfolios to cater to diverse clinical applications, strategic collaborations and partnerships to enhance distribution networks and market penetration, and investments in research and development to innovate new features and functionalities that address unmet needs in the healthcare sector.

Challenges

Despite the promising growth prospects, the portable ultrasound devices market faces challenges such as regulatory hurdles associated with product approvals and quality standards, concerns regarding the accuracy and reliability of portable ultrasound imaging compared to traditional systems, and limited reimbursement policies for portable imaging procedures in certain regions, which may hinder market growth to some extent.

Read Also: Blood and Blood Components Market Size, Growth, Report by 2033

Portable Ultrasound Devices Market Recent Developments

- In May 2024, Esaote SPA launched a portable ultrasound system named ‘MyLab Omega eXP VET.’ This system will help veterinarians examine animals with a high level of flexibility and accuracy in diagnostic imaging. It also covers animals of all species and ensures high performance, ranging from general imaging and echocardiography to interventional procedures.

- In April 2024, Butterfly announced that the FDA had approved its next-generation handheld point-of-care ultrasound (POCUS) system named iQ3. This new device features a new ergonomic design and delivers high data processing speed for optimized image resolution and accuracy for the detection of various body parts.

- In November 2023, Aco Healthcare launched its new handheld ultrasound system, Apache Neo. This system features microwave-beamforming imaging technology that provides high-resolution medical images and accurate diagnosis to enhance patients’ overall medical experience.

- In September 2023, Mindray Medical International Limited launched the TE Air wireless handheld ultrasound device. This device offers multi-device connectivity and flexible charging options. It also produces high-quality images and ensures accessibility in critical clinical scenarios.

- In August 2023, GE HealthCare launched Vscan Air SL, a wireless handheld ultrasound device designed to accelerate the imaging process during cardiac and vascular problems. This device comes with GE HealthCare’s proprietary XDclear and SignalMax technology to enhance resolution and improve imaging performance.

Portable Ultrasound Devices Market Companies

- General Electric Company

- Siemens

- Clarius Mobile Health

- Koninklijke Philips N.V.

- SAMSUNG

- FUJIFILM Holdings Corporation

- Shenzhen Mindray Bio-medical Electronics Co., Ltd.

- Canon Inc.

- BenQ Corporation

- ESAOTE SPA

- Hitachi

- Butterfly Network

Segments Covered in the Report

By Type

- Laptop-based

- Handheld

By Application

- Obstetrics/Gynecology

- Cardiovascular

- Urology

- Gastric

- Musculoskeletal

- Others

By Technology

- 2D Ultrasound

- 3D & 4D Ultrasound

- Doppler Ultrasound

- High-intensity Focused Ultrasound

By End-Use

- Hospitals & Clinics

- Home Care

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/