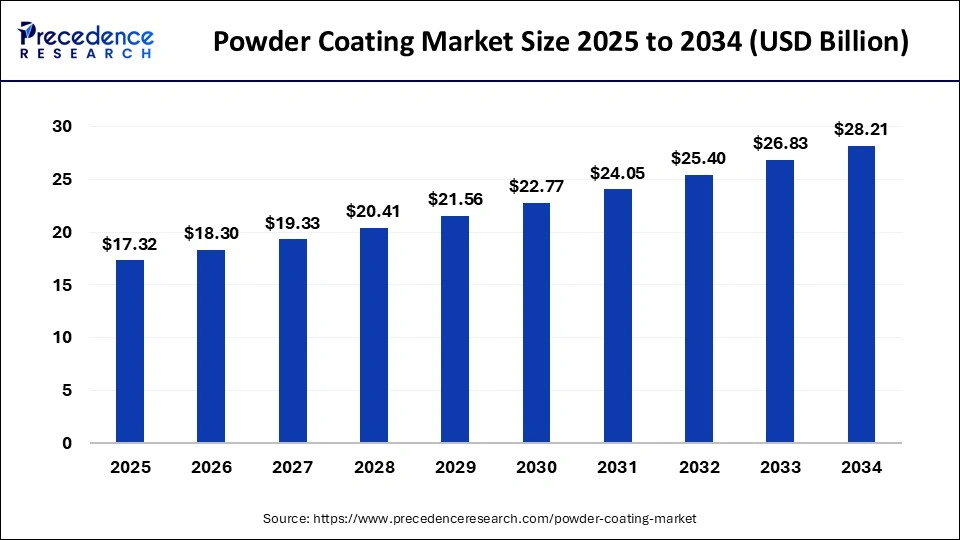

Powder coating market size projected to hit USD 28.21 billion by 2034 from USD 16.40 billion in 2024, expanding at a CAGR of 5.57%.

Powder Coating Market Key Takeaways

- Asia Pacific led the powder coating market in 2024, capturing over 40% of the total revenue share.

- North America is expected to register the fastest growth rate during the forecast period.

- The consumer goods segment dominated the market by application in 2024.

- The polyester segment accounted for the largest market share by resin type in 2024.

- The epoxy-polyester segment is projected to grow rapidly over the forecast period.

Market Overview

The powder coating market has experienced significant growth in recent years due to the increasing demand for durable, environmentally friendly, and cost-effective coating solutions across various industries. Powder coating is a dry finishing process that involves the application of a free-flowing powder to surfaces, which is then cured under heat to create a smooth, durable, and high-quality finish. It is widely used in industries such as automotive, construction, appliances, furniture, and consumer goods due to its superior performance, resistance to corrosion, and minimal environmental impact.

The rising demand for eco-friendly coating solutions, coupled with stringent regulations on volatile organic compounds (VOCs), has prompted industries to shift toward powder coatings. These coatings provide better durability and performance than conventional liquid paints, making them an ideal choice for applications that require resistance to abrasion, chemicals, and harsh environmental conditions. The ongoing advancements in powder coating technology, such as the development of heat-sensitive and UV-cured coatings, are further driving market growth by offering enhanced efficiency and versatility.

Drivers

-

Increasing Demand for Eco-Friendly Coatings

The growing focus on reducing environmental impact has led to increased adoption of powder coatings, which contain negligible or no VOCs compared to traditional liquid coatings. This shift is driven by stringent environmental regulations imposed by regulatory bodies across the globe, encouraging industries to adopt sustainable coating solutions. -

Growth in the Automotive and Consumer Goods Sectors

The automotive and consumer goods industries are major contributors to the demand for powder coatings. In the automotive sector, powder coatings are used extensively for underbody coatings, wheels, and other critical components due to their ability to withstand harsh conditions and resist corrosion. Similarly, the consumer goods segment, including household appliances and furniture, relies on powder coatings for enhancing product aesthetics and durability. -

Rising Infrastructure Development and Construction Activities

The surge in construction activities, particularly in developing economies, has increased the demand for powder coatings in architectural applications such as aluminum profiles, doors, windows, and other metal structures. The superior protection and durability offered by powder coatings make them an ideal choice for construction materials exposed to outdoor environments. -

Technological Advancements in Powder Coating Formulations

Innovations in powder coating formulations, including the development of hybrid coatings, heat-sensitive formulations, and UV-cured powders, have expanded the application scope of powder coatings. These advancements enable faster curing, energy savings, and improved surface protection, driving higher adoption across industries.

Opportunities

-

Expansion of Electric Vehicles and Lightweight Automotive Components

The rapid adoption of electric vehicles (EVs) and the increasing use of lightweight automotive components present lucrative opportunities for the powder coating market. Powder coatings are extensively used in EV battery casings, charging stations, and lightweight automotive parts, creating a growing market segment. -

Growing Demand for Customized and Specialty Coatings

The rising trend of customization and the need for specialty coatings in industries such as furniture, automotive, and consumer goods open new growth avenues for the powder coating market. Manufacturers are focusing on developing specialty coatings with enhanced aesthetics, texture, and functionality to meet diverse consumer preferences. -

Increasing Adoption of Smart Coating Technologies

The growing emphasis on smart and functional coatings, which provide self-cleaning, antimicrobial, and anti-corrosion properties, is creating opportunities for powder coating manufacturers. Smart coatings are gaining traction in healthcare, construction, and electronics industries, driving demand for innovative powder coating solutions.

Challenges

-

High Initial Investment and Process Complexity

The powder coating process requires specialized equipment and curing technologies, resulting in higher initial investment costs for manufacturers. The complexity associated with achieving uniform coating thickness and minimizing defects during the curing process poses operational challenges. -

Limitations in Application on Heat-Sensitive Substrates

One of the significant challenges in the powder coating market is its limited applicability on heat-sensitive substrates such as plastics and wood. Traditional powder coatings require high curing temperatures, making them unsuitable for materials that cannot withstand heat. -

Volatility in Raw Material Prices

The fluctuating prices of raw materials, including resins and pigments used in powder coating formulations, can impact the profitability of manufacturers. Variations in supply chain dynamics and geopolitical factors contribute to price volatility, posing a challenge for market players.

Regional Insights

-

Asia Pacific

Asia Pacific dominated the powder coating market in 2024, accounting for over 40% of the total market revenue. The region’s growth is driven by rapid industrialization, increasing automotive production, and growing construction activities in countries such as China and India. Rising disposable income and urbanization further contribute to the expanding demand for consumer goods and home appliances, fueling market growth. -

North America

North America is expected to grow at the fastest rate during the projection period due to the increasing adoption of eco-friendly coating solutions and the rising demand for high-performance coatings in the automotive and aerospace industries. The region’s emphasis on sustainable development and regulatory compliance has led to a steady shift toward powder coatings. -

Europe

Europe holds a significant share in the powder coating market, driven by stringent environmental regulations and a strong presence of automotive and industrial manufacturing sectors. The region’s focus on reducing carbon emissions and enhancing energy efficiency has encouraged the adoption of sustainable coating technologies. -

Middle East and Africa

The Middle East and Africa region is witnessing steady growth in the powder coating market, fueled by increasing construction activities and infrastructure development. Government initiatives aimed at diversifying the economy and promoting industrial growth have further boosted the demand for powder coatings in the region.

Recent News

-

Launch of Eco-Friendly Powder Coatings for Automotive Applications

Leading manufacturers have introduced environmentally sustainable powder coatings specifically designed for automotive applications, offering improved performance and reduced environmental impact. -

Expansion of Production Facilities to Meet Growing Demand

Key players in the powder coating market are expanding their production facilities to cater to the rising demand from various industries

Powder Coating Market Companies

- Axalta Coating Systems

- The Sherwin-Williams Company

- Arkema Group

- The Valspar Corporation

- Eastman Chemical Company

- PPG Industries, Inc.

- Akzo Nobel NV

- Evonik Industries AG

- Nippon Paint Co., Ltd.

Segments Covered in the Report

By Resin

- Epoxy-Polyester

- Epoxy

- Acrylic

- Polyester

- Polyurethane

- Others

By Application

- Automotive

- Consumer Goods

- Architectural

- Furniture

- Oil and Gas

- Pipeline

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/