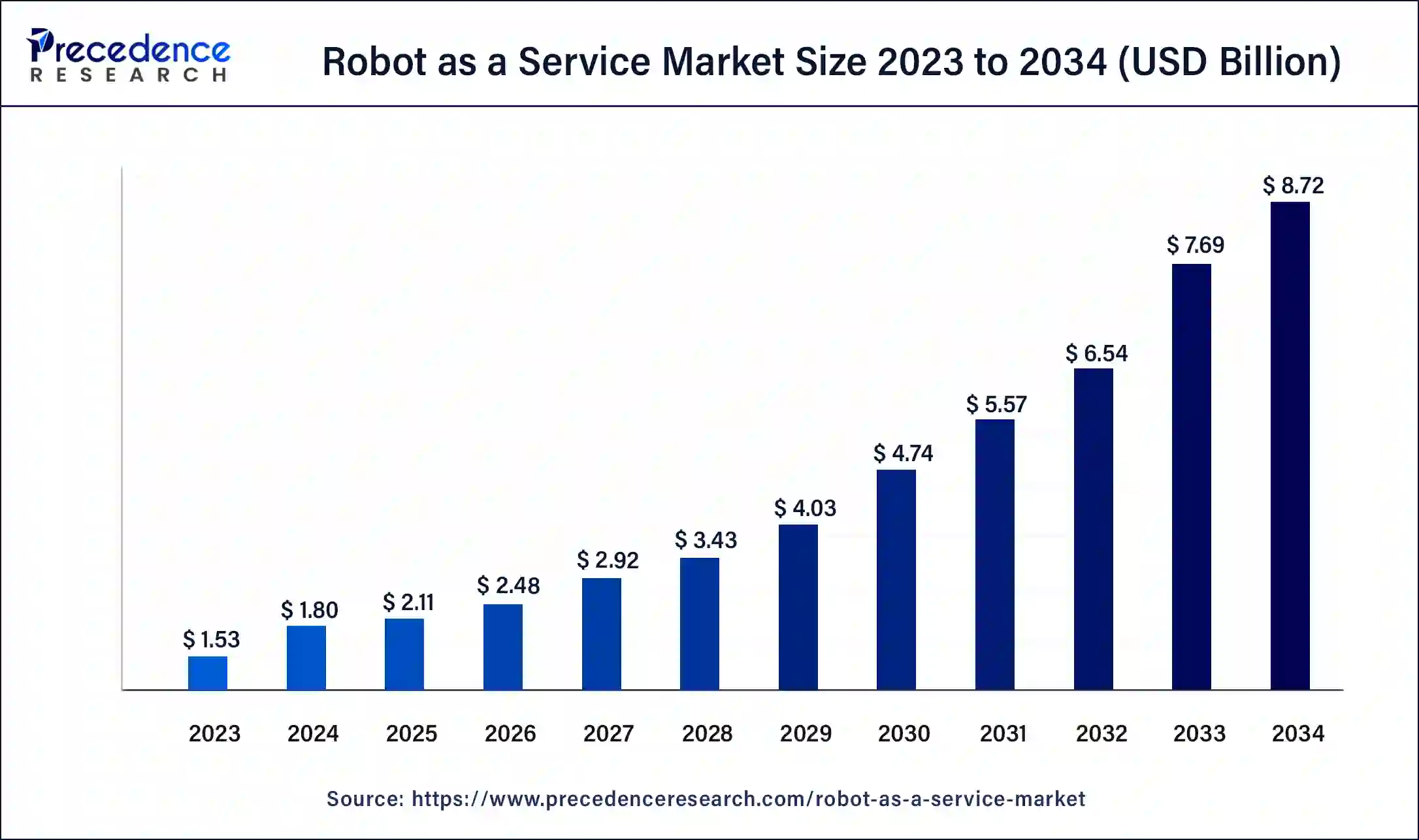

The global robot as a service market size accounted for USD 1.53 billion in 2023 and is anticipated to grow around USD 7.69 billion by 2033, expanding at a CAGR of 17.52% from 2024 to 2033.

Key Points

- North America has accounted more than 38% of the market share in 2023.

- Asia Pacific is expected to expand at the fastest CAGR of 20.04% during the forecast period.

- By enterprise size, the large enterprises segment has accounted more than 70% of market share in 2023.

- By enterprise size, the small & medium enterprises segment is expected to grow at a CAGR of 19.04% between 2024 and 2033.

- By application, the handling application segment has held the major market share of 37% in 2023.

- By industry verticals, the automotive industry segment accounted for the highest market share of 18% in 2023.

The Robot as a Service (RaaS) market has experienced significant growth in recent years, driven by the increasing adoption of robots across various industries. RaaS refers to the business model where companies offer robots and automation solutions as a service, rather than selling them outright to customers. This model allows organizations to access advanced robotics technology without the need for heavy upfront investment, making it an attractive option for businesses looking to streamline operations and improve efficiency.

The global RaaS market has witnessed robust expansion, with a compound annual growth rate (CAGR) exceeding expectations. Factors such as advancements in robotics technology, growing demand for automation across industries, and the need for cost-effective solutions have propelled the market forward. Moreover, the flexibility offered by RaaS models, including scalability and customization options, has further accelerated its adoption across diverse sectors.

Get a Sample: https://www.precedenceresearch.com/sample/4016

Growth Factors:

Several key factors are driving the growth of the RaaS market. Firstly, advancements in robotics technology, including artificial intelligence (AI), machine learning, and sensor technology, have enhanced the capabilities of robots, making them more versatile and adaptable to various tasks. Additionally, the increasing demand for automation solutions to streamline operations, reduce labor costs, and improve productivity is fueling the adoption of RaaS models across industries such as manufacturing, logistics, healthcare, and retail.

Moreover, the rise of Industry 4.0 and the Internet of Things (IoT) has created opportunities for integrating robots into interconnected systems, enabling seamless communication and coordination between machines and processes. This convergence of technologies is driving the development of collaborative robots (cobots) that can work alongside human workers safely, further expanding the potential applications of RaaS solutions.

Furthermore, the shift towards a service-based economy and the growing preference for subscription-based models among businesses are driving the demand for RaaS offerings. By leveraging RaaS, companies can access cutting-edge robotics technology without significant capital investment, while also benefiting from ongoing maintenance, updates, and support services provided by RaaS providers.

Region Insights:

The adoption of RaaS solutions varies across regions, influenced by factors such as technological infrastructure, industry trends, regulatory environment, and economic conditions. North America has emerged as a leading market for RaaS, driven by the presence of established technology companies, high levels of automation in industries such as automotive and electronics manufacturing, and strong demand for innovative solutions.

Europe is also experiencing significant growth in the RaaS market, supported by initiatives such as Industry 4.0 and the European Union’s focus on promoting digitalization and automation across sectors. Countries like Germany, France, and the United Kingdom are key markets for RaaS, with industries such as automotive, aerospace, and healthcare driving adoption.

In Asia-Pacific, rapid industrialization, expanding manufacturing sectors, and increasing investment in robotics and automation are driving the growth of the RaaS market. Countries like China, Japan, and South Korea are at the forefront of robotics innovation and adoption, with a growing number of companies exploring RaaS offerings to enhance operational efficiency and competitiveness.

Robot as a Service Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 17.52% |

| Global Market Size in 2023 | USD 1.53 Billion |

| Global Market Size by 2033 | USD 7.69 Billion |

| U.S. Market Size in 2023 | USD 440 Million |

| U.S. Market Size by 2033 | USD 2,190 Million |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Enterprise Size, By Application, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Robot as a Service Market Dynamics

Drivers:

Several drivers are propelling the growth of the RaaS market. One of the primary drivers is the need for cost-effective automation solutions, especially among small and medium-sized enterprises (SMEs) that may not have the resources to invest in expensive robotics equipment upfront. RaaS models offer these businesses access to cutting-edge technology on a subscription basis, enabling them to stay competitive without significant capital expenditure.

Additionally, the increasing complexity of tasks in industries such as manufacturing, logistics, and healthcare is driving demand for robots with advanced capabilities. RaaS providers are responding to this demand by offering a wide range of robotic solutions tailored to specific industry needs, including material handling, inspection, assembly, and collaborative robotics.

Moreover, the ongoing digital transformation across industries is creating opportunities for RaaS providers to offer integrated solutions that leverage robotics, AI, IoT, and data analytics to optimize processes and drive innovation. By partnering with RaaS providers, businesses can access comprehensive automation solutions that enhance productivity, quality, and safety while reducing operational costs.

Furthermore, the COVID-19 pandemic has accelerated the adoption of automation and robotics in response to disruptions in global supply chains, labor shortages, and the need for social distancing measures. RaaS offerings, particularly in areas such as warehousing, logistics, and healthcare, have gained traction as companies seek flexible and resilient solutions to navigate the challenges posed by the pandemic.

Opportunities:

The RaaS market presents several opportunities for growth and innovation. One key opportunity lies in expanding the application of robotics beyond traditional industries to emerging sectors such as agriculture, construction, hospitality, and entertainment. By developing specialized robots and tailored RaaS solutions for these industries, providers can tap into new markets and address unique challenges and requirements.

Additionally, there is potential for collaboration and partnerships between RaaS providers, technology companies, industry players, and academic institutions to drive innovation and develop next-generation robotics solutions. By leveraging expertise from multiple stakeholders and fostering an ecosystem of innovation, RaaS providers can accelerate the development and adoption of advanced robotics technology.

Furthermore, the integration of RaaS offerings with other emerging technologies such as 5G, edge computing, and augmented reality (AR) presents opportunities to enhance the capabilities and functionality of robotic systems. By harnessing the power of connectivity and real-time data processing, RaaS providers can enable remote monitoring, predictive maintenance, and immersive user experiences, opening up new possibilities for automation and efficiency.

Moreover, as environmental sustainability becomes a greater concern for businesses and consumers, there is an opportunity for RaaS providers to develop eco-friendly robotics solutions that minimize energy consumption, reduce waste, and optimize resource usage. By aligning RaaS offerings with sustainability goals, providers can appeal to environmentally conscious customers and differentiate themselves in the market.

Challenges:

Despite the promising growth prospects, the RaaS market faces several challenges that could hinder its expansion. One major challenge is the complexity of integrating robotics into existing workflows and processes, especially in industries with legacy systems and infrastructure. RaaS providers must work closely with clients to understand their specific needs and requirements and tailor solutions that seamlessly integrate with their operations.

Additionally, concerns around data security, privacy, and regulatory compliance pose challenges for RaaS providers, particularly in industries such as healthcare and finance where sensitive information is involved. Providers must implement robust cybersecurity measures, adhere to data protection regulations, and address privacy concerns to build trust and credibility with customers.

Moreover, the upfront costs associated with developing and deploying robotics technology can be prohibitive for RaaS providers, especially startups and smaller companies. Investing in research and development (R&D), hardware components, software development, and infrastructure requires significant capital investment, which may pose challenges for providers seeking to scale their operations and compete effectively in the market.

Furthermore, there is a risk of job displacement and resistance from workers concerned about the impact of automation on employment opportunities and job security. RaaS providers must address these concerns by emphasizing the potential for robotics to augment human labor rather than replace it, highlighting the benefits of automation in terms of efficiency, safety, and skill enhancement.

Read Also: Barrier Films Market Size to Grow USD 61.86 Billion by 2033

Recent Developments

- In November 2022, Smart Robotics Inc. developed a smart robot that can pick products from enterprises’ manufacturing sites. This COBOT collaborative robot can handle lightweight products such as office stationery and papers.

- In February 2022, Ricoh acquired Axon Ivy AG as a strategic investment to expand its digital process automation capacity and strengthen its roots in the global market as a robot service provider.

Robot as a Service Market Companies

- Ademco Global

- Aethon

- ABB Group

- Amazon Web Services Inc.

- Beetl Robotics

- Berkshire Grey Inc.

- Cobalt Robotics

- CYBERDYNE Inc.

- Fanuc Corporation

- iRobot Corporation

- inVia Robotics

- Kongsberg Maritime

- KUKA AG

- Locus Robotics

- Northrop Grumman

- RedZone Robotics

- Relay Robotics

- Yaskawa Electric Corporation

Segments Covered in the Report

By Enterprise Size

- Small & Medium Enterprises

- Large Enterprises

By Application

- Handling

- Assembling And Disassembling

- Dispensing

- Processing

- Welding And Soldering

- Others

By Industry Vertical

- BFSI

- Défense

- Healthcare

- Automotive

- Manufacturing

- Retail

- Telecom & IT

- Logistics & Transportation

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/