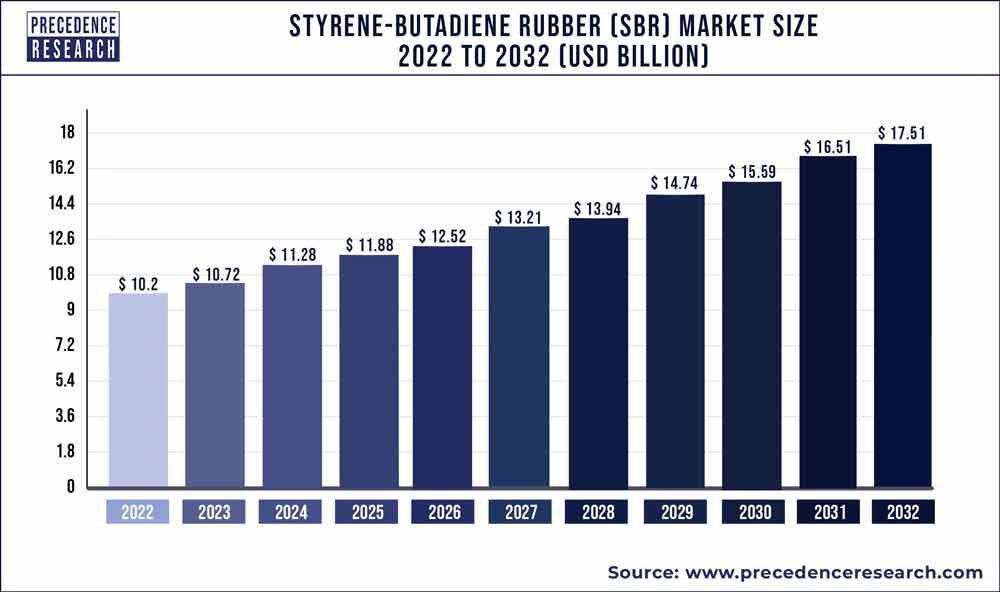

The styrene-butadiene rubber market size was valued at USD 10.72 billion in 2023 and is expected to reach USD 17.51 billion by 2032, growing at a CAGR of 5.60% from 2023 to 2032.

Key Takeaways

- Asia-Pacific contributed more than 33% of revenue share in 2022.

- North America is estimated to expand the fastest CAGR between 2023 and 2032.

- By type, the emulsion SBR segment has held the largest market share of 65% in 2022.

- By type, the solution SBR segment is anticipated to grow at a remarkable CAGR of 6.5% between 2023 and 2032.

- By application, the tire segment generated over 31% of revenue share in 2022.

- By application, the footwear segment is expected to expand at the fastest CAGR over the projected period.

The Styrene-Butadiene Rubber (SBR) market has experienced notable growth in recent years. SBR, a synthetic rubber derived from styrene and butadiene, is widely used in the manufacturing of tires, footwear, and various industrial goods. The market’s expansion can be attributed to the increasing demand for high-performance tires in the automotive sector, driven by the global rise in vehicle production and sales. Additionally, SBR’s versatility and cost-effectiveness have made it a preferred choice in the production of various rubber products, further contributing to market growth.

Several factors fuel the growth of the Styrene-Butadiene Rubber market. Firstly, the automotive industry’s continuous expansion is a significant driver, with SBR being a key component in tire manufacturing. As the demand for fuel-efficient and durable tires rises, so does the need for SBR. Moreover, the construction industry’s growth also plays a pivotal role, as SBR is utilized in various construction materials, such as adhesives and sealants. This dual demand from automotive and construction sectors acts as a robust growth factor for the Styrene-Butadiene Rubber market.

Get a Sample: https://www.precedenceresearch.com/sample/3580

Environmental concerns and regulations have also influenced the market’s dynamics. The increasing emphasis on sustainable and eco-friendly materials has led to the development of bio-based SBR, opening new avenues for growth. Manufacturers are investing in research and development to create SBR with improved performance characteristics while reducing its environmental impact. This innovation-driven approach contributes to the market’s resilience and attractiveness.

Global economic trends, trade policies, and geopolitical factors also influence the Styrene-Butadiene Rubber market. The market is sensitive to fluctuations in raw material prices, particularly styrene and butadiene. Strategic alliances, mergers, and acquisitions within the industry have become common as companies seek to strengthen their market positions and enhance their product portfolios. This competitive landscape contributes to the overall growth and evolution of the Styrene-Butadiene Rubber market.

Styrene-Butadiene Rubber (SBR) Market Scope

| Report Coverage | Details |

| Growth Rate from 2023 to 2032 | CAGR of 5.60% |

| Market Size in 2023 | USD 10.72 Billion |

| Market Size by 2032 | USD 17.51 Billion |

| Largest Market | Asia-Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Type and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Read More: Traction Inverter Market Size To Reach USD 73.08 Bn By 2032

Type

Styrene-butadiene rubber (SBR) exhibits diverse characteristics based on its types, commonly categorized as emulsion SBR (ESBR) and solution SBR (SSBR). Emulsion SBR, produced through a polymerization process in water, is renowned for its ease of use and environmental friendliness. It finds extensive application in the tire industry, owing to its excellent abrasion resistance and gripping capabilities. On the other hand, solution SBR, synthesized in a solvent medium, is favored for its superior performance in enhancing fuel efficiency and overall tire performance. The choice between these types often depends on the specific requirements of end-use applications.

Application

The applications of Styrene-Butadiene Rubber span across various industries, with the tire manufacturing sector being a major consumer. SBR’s remarkable abrasion resistance and good wear characteristics make it a staple in tire production, contributing significantly to the automotive industry’s growth. Additionally, the polymer’s versatility extends to the production of conveyor belts, footwear, and adhesives, where its durability and cost-effectiveness play a pivotal role. Furthermore, SBR is increasingly gaining traction in the construction industry for its application in asphalt modification, providing enhanced road quality and longevity. As sustainability becomes a focal point in various industries, SBR’s recyclability and eco-friendly attributes further elevate its standing in the global market.

Reasons to Purchase this Report:

- Comprehensive market segmentation analysis incorporating qualitative and quantitative research, considering the impact of economic and policy factors.

- In-depth regional and country-level analysis, examining the demand and supply dynamics that influence market growth.

- Market size in USD million and volume in million units provided for each segment and sub-segment.

- Detailed competitive landscape, including market share of major players, recent projects, and strategies implemented over the past five years.

- Comprehensive company profiles encompassing product offerings, key financial information, recent developments, SWOT analysis, and employed strategies by major market players.

Recent Developments

- In February 2023, Arlanxeo inaugurated a new polybutadiene (PBR) production line with a capacity of 65 kilotons per annum in southern Brazil. The expansion aims to enhance the rubber production flexibility at the Triunfo facility, reflecting the industry’s commitment to meeting increasing demand for rubber products.

- In November 2022, Asahi Kasei Corporation commenced the sale of Tufdene S-SBR and Asadene BR, both produced using the mass-balance method, at its facilities in Singapore and Kawasaki. The sale is underpinned by the ISCC PLUS2 certification obtained in October 2022, signaling a commitment to sustainable and responsible production practices in the synthesis of styrene-butadiene rubber and butadiene rubber.

Styrene-Butadiene Rubber Market Players

- Lanxess AG

- Sinopec

- Kumho Petrochemical Co., Ltd.

- Asahi Kasei Corporation

- The Goodyear Tire & Rubber Company

- LG Chem

- JSR Corporation

- Trinseo

- Michelin

- Bridgestone Corporation

- Versalis S.p.A. (Eni)

- Synthos S.A.

- Zeon Corporation

- Nizhnekamskneftekhim

- Eastman Chemical Company

Segments Covered in the Report

By Type

- Emulsion SBR

- Solution SBR

By Application

- Tires

- Adhesives

- Footwear

- Other Applications

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

TABLE OF CONTENT

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology (Premium Insights)

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Styrene-Butadiene Rubber Market

5.1. COVID-19 Landscape: Styrene-Butadiene Rubber Industry Impact

5.2. COVID 19 – Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Styrene-Butadiene Rubber Market, By Type

8.1. Styrene-Butadiene Rubber Market Revenue and Volume, by Type, 2023-2032

8.1.1. Emulsion SBR

8.1.1.1. Market Revenue and Volume Forecast (2020-2032)

8.1.2. Solution SB

8.1.2.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 9. Global Styrene-Butadiene Rubber Market, By Application

9.1. Styrene-Butadiene Rubber Market Revenue and Volume, by Application, 2023-2032

9.1.1. Tires

9.1.1.1. Market Revenue and Volume Forecast (2020-2032)

9.1.2. Adhesives

9.1.2.1. Market Revenue and Volume Forecast (2020-2032)

9.1.3. Footwear

9.1.3.1. Market Revenue and Volume Forecast (2020-2032)

9.1.4. Other Applications

9.1.4.1. Market Revenue and Volume Forecast (2020-2032)

Chapter 10. Global Styrene-Butadiene Rubber Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.1.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.1.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.1.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.5.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.2.6.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.5.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.3.6.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.5.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.4.6.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.5.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.5.3.2. Market Revenue and Volume Forecast, by Application (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Volume Forecast, by Type (2020-2032)

10.5.4.2. Market Revenue and Volume Forecast, by Application (2020-2032)

Chapter 11. Company Profiles

11.1. Lanxess AG

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Sinopec

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Kumho Petrochemical Co., Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Asahi Kasei Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. Recent Initiatives

11.5. The Goodyear Tire & Rubber Company

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. LG Chem

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. JSR Corporation

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Trinseo

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Michelin

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Bridgestone Corporation

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/