- By medication, the quick relief medications segment dominated the market in 2023, the segment is observed to witness a notable growth during the forecast period.

- By mode of administration, the inhalers segment dominated the U.S. asthma drugs market in 2023. The segment is observed to sustain the position during the forecast period.

- By organization type, the public segment is expected to sustain its dominance throughout the forecast period.

- By application, the adults segment was observed to dominate the U.S. asthma drugs market in 2023.

- By application, the pediatric segment is expected to show substantial growth during the forecast period.

The U.S. Asthma Drugs Market is a dynamic and vital component of the country’s healthcare sector, addressing the pressing health concerns associated with asthma. Asthma, a chronic respiratory condition, affects millions of Americans, and the demand for effective asthma drugs remains consistently high. This market encompasses a wide array of pharmaceutical products aimed at managing and alleviating the symptoms of asthma, ensuring a better quality of life for patients. As advancements in medical research and technology continue, the U.S. Asthma Drugs Market is witnessing notable growth and evolution.

Get a Sample: https://www.precedenceresearch.com/sample/3757

Growth Factors

Several factors contribute to the growth of the U.S. Asthma Drugs Market. Firstly, the increasing prevalence of asthma cases across diverse age groups creates a substantial demand for innovative and efficient drug solutions. Additionally, a rising awareness about the importance of early diagnosis and treatment fosters a proactive approach among both patients and healthcare providers, further boosting market growth. The continuous development of novel asthma medications, including biologics and targeted therapies, plays a pivotal role in expanding the market by providing more personalized and effective treatment options.

Furthermore, the collaborative efforts between pharmaceutical companies and research institutions contribute to a robust pipeline of asthma drugs, ensuring a steady influx of new and improved medications. The emphasis on patient-centric approaches, along with the integration of digital health technologies, enhances disease management strategies, thereby positively impacting market growth. As the healthcare landscape continues to prioritize respiratory health, the U.S. Asthma Drugs Market is poised for sustained expansion.

U.S. Asthma Drugs Market Scope

| Report Coverage | Details |

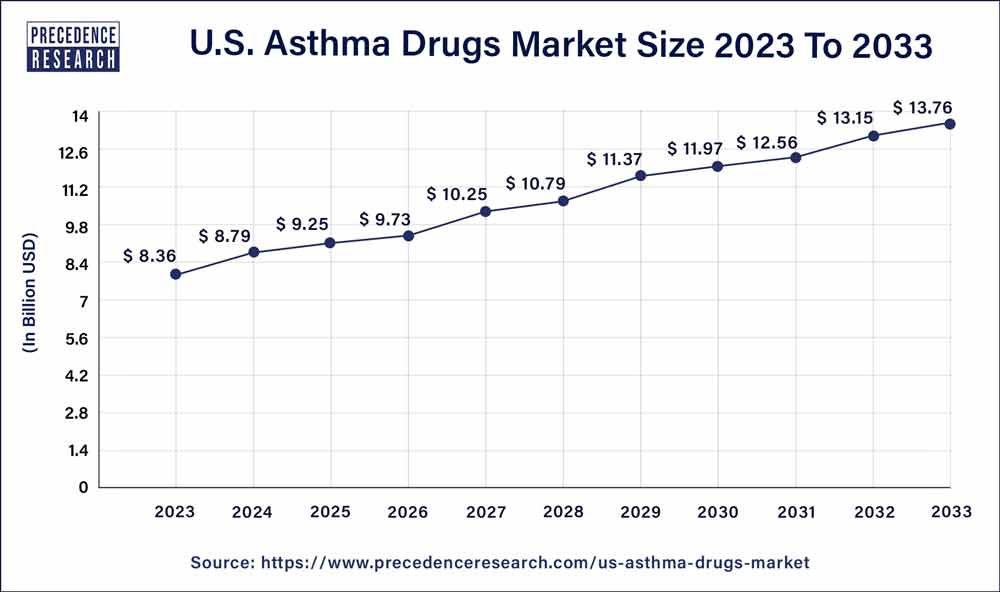

| Growth Rate from 2024 to 2033 | CAGR of 5.11% |

| U.S. Market Size in 2023 | USD 8.36 Billion |

| U.S. Market Size by 2033 | USD 13.76 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Medication, By Mode of Administration, By Source, By Organization Type, and By Application |

Recent Developments

- In January 2023, in the United States, Airsupra (albuterol/budesonide), formerly known as PT027, received recognition as a preventive or as-needed treatment for bronchoconstriction, as well as to lower the risk of exacerbations in individuals with asthma who are 18 years of age or older. The FDA’s clearance was granted based on the outcomes of the Phase III studies for MANDALA and DENALI.

- In July 2023, the U.S. Food and Drug Administration approved the first generic version of AstraZeneca’s Symbicort®, BreynaTM (budesonide and formoterol fumarate dihydrate) Inhalation Aerosol. The drug is a result of a collaboration between Viatris Inc., a global healthcare company, and Kindeva Drug Delivery L.P. It is recommended for certain people who suffer from asthma or chronic obstructive pulmonary disease (COPD).

- In December 2023, an exclusive license agreement was announced to develop a potential novel antibody-based therapy for the treatment of asthma and atopic dermatitis by Teva Pharmaceutical Industries Ltd. and Biolojic Design Ltd., a biotechnology company that turns antibodies into intelligent medicinal solutions using computational biology and artificial intelligence.

U.S. Asthma Drugs Market Dynamics

Drivers:

The U.S. Asthma Drugs Market is primarily driven by technological advancements in drug development, leading to the introduction of innovative and more targeted therapeutic options. The increasing adoption of precision medicine, incorporating genetic and biomarker data for personalized treatment approaches, is a notable driver. This approach not only enhances treatment efficacy but also minimizes adverse effects, contributing to better patient outcomes.

Moreover, the expanding understanding of the intricate mechanisms underlying asthma pathophysiology facilitates the development of drugs targeting specific molecular pathways. The surge in research and development activities, fueled by government initiatives and private investments, is a key driver propelling the market forward. Additionally, the growing prevalence of allergic conditions and environmental factors contributing to asthma exacerbations further fuels the demand for effective and tailored drug solutions.

Restraints:

Despite the positive growth trajectory, the U.S. Asthma Drugs Market faces certain restraints. Economic factors, such as the high cost of innovative asthma medications, may limit accessibility for some patients. Insurance coverage limitations and reimbursement challenges could pose obstacles to the widespread adoption of certain advanced therapies. Regulatory complexities and stringent approval processes also contribute to delays in bringing new drugs to the market, impacting the pace of growth.

Another significant restraint is the potential side effects associated with certain asthma medications. Balancing the need for symptom relief with the risk of adverse reactions poses challenges for healthcare providers and may influence treatment decisions. Additionally, the presence of generic alternatives for some widely prescribed drugs could create pricing pressures, affecting profit margins for pharmaceutical companies operating in the asthma drug market.

Opportunity:

The U.S. Asthma Drugs Market presents several opportunities for stakeholders to explore and capitalize on. The integration of digital health solutions, such as telemedicine and mobile health apps, opens avenues for remote patient monitoring and personalized care plans. This not only enhances patient engagement but also contributes to better treatment adherence and outcomes.

Furthermore, collaborative partnerships and strategic alliances between pharmaceutical companies and healthcare organizations can accelerate research and development efforts. Investing in research focused on identifying novel therapeutic targets and developing breakthrough medications presents a substantial opportunity for market players to differentiate themselves and gain a competitive edge.

Additionally, raising awareness about asthma prevention and management through educational campaigns and community outreach programs can create a more informed patient population. This proactive approach not only contributes to early diagnosis but also fosters a supportive ecosystem for asthma patients, driving market growth.

Read Also: Artificial Lights Market Size to Rake USD 123.69 Bn by 2033

U.S. Asthma Drugs Market Companies

- GlaxoSmithKline

- Pfizer

- Vectura Group

- Boehringer Ingelheim

- Roche

- Novartis

- Merck

- AstraZeneca

- Teva Pharmaceutical

Segments Covered in the Report

By Medication

- Quick Relief Medications

- Long-term Control Medications

- Others

By Mode of Administration

- Tablets and Capsules

- Liquids

- Inhalers

- Injections

- Sprays and Powders

By Source

- Environmental

- Generic

By Organization Type

- Public

- Private

By Application

- Pediatric

- Adults

- Adolescent

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/