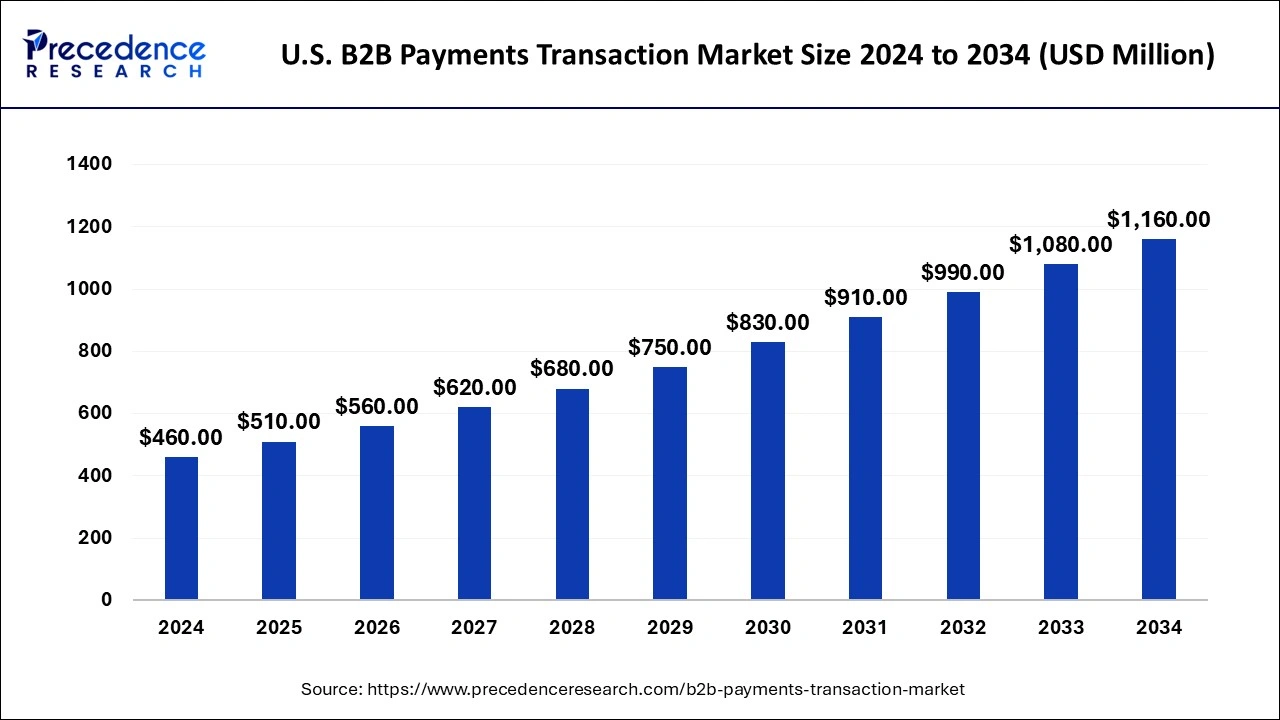

The U.S. B2B payments transaction market size accounted for USD 410 billion in 2023 and is anticipated to touch around USD 1,080 billion by 2033, growing at a CAGR of 9.95% from 2024 to 2033.

Key Points

- By payment type, the domestic payment dominated the market with the largest share in 2023.

- By payment mode, the ACH segment dominated the U.S. B2B payments transaction market with the largest share in 2023.

- By enterprise size, the large enterprise segment dominated the market in 2023.

- By industry, manufacturing segment dominated the market with the highest market share in 2023.

- By industry, the BFSI was the second largest segment while it held a considerable share of the market in 2023.

The U.S. B2B payments transaction market encompasses the exchange of payments between businesses for goods and services. It involves a wide array of payment methods, including electronic transfers, credit cards, checks, and emerging technologies like virtual cards and blockchain-based transactions. This market plays a critical role in facilitating commerce and financial transactions across various industries, driving efficiency and transparency in business-to-business interactions.

Get a Sample: https://www.precedenceresearch.com/sample/4292

Growth Factors

Several key factors are driving the growth of the U.S. B2B payments transaction market. One significant factor is the increasing adoption of digital payment solutions by businesses to streamline operations and reduce costs associated with traditional paper-based processes. Additionally, the rise of e-commerce and online marketplaces has spurred demand for efficient and secure payment methods tailored to B2B transactions. The evolution of fintech and payment technology firms offering innovative solutions is also fueling market growth.

In the U.S., the B2B payments transaction market is dynamic and varies regionally based on industry concentration, business ecosystems, and technological infrastructure. Major metropolitan areas and hubs of industry such as New York, San Francisco, and Chicago often exhibit higher adoption rates of digital B2B payment solutions due to the concentration of businesses and financial institutions.

U.S. B2B Payments Transaction Market Scope

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 9.95% |

| U.S. B2B Payments Transaction Market Size in 2023 | USD 410 Billion |

| U.S. B2B Payments Transaction Market Size in 2024 | USD 460 Billion |

| U.S. B2B Payments Transaction Market Size by 2033 | USD 1,080 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Payment, By Payment Mode, By Enterprise Size, and By Industry |

U.S. B2B Payments Transaction Market Dynamics

Drivers:

The shift towards digital transformation in businesses is a significant driver for the growth of B2B payments transactions in the U.S. Companies are increasingly seeking faster, more secure, and efficient ways to manage their financial operations. Moreover, regulatory initiatives aimed at promoting transparency and security in payments, such as PSD2 (Payment Services Directive 2), are encouraging businesses to adopt modern payment technologies.

Opportunities:

There are abundant opportunities in the U.S. B2B payments transaction market for technology providers, financial institutions, and fintech startups. Innovations in areas like real-time payments, artificial intelligence for fraud detection, and blockchain-based settlements present opportunities to capture market share and offer value-added services to businesses looking to optimize their payment processes.

Challenges:

Despite the growth potential, the U.S. B2B payments transaction market faces challenges such as interoperability issues between different payment systems, legacy infrastructure limitations in some industries, and concerns around data security and compliance. Overcoming these challenges will require collaboration between industry stakeholders and continuous investment in technology and regulatory frameworks.

Read Also: Smart Display Market Size to Touch USD 51.47 Billion by 2033

U.S. B2B Payments Transaction Market Recent Developments

- In April 2024, Paystand, a blockchain-enabled B2B payments network, acquired Teampay, a management software provider for increasing the B2B payments services. The transaction will work on the B2B payments powerhouse aiming to revolutionalize payement by increasing fastest, largest, and the most cost-efficient B2B payment network.

- In April 2024, Airwallex, a global leader in the financial and payment platform for new-age businesses announced the launch of payment acceptance solutions in US. The launch is offered to the merchant in US to accept the payments from the domestic and international customers.

- In April 2024, FedNow is work as a revolutionary force in real-time payments marking a significant shift from the traditional Automated Clearing House (ACH) system. A shit is the banking revolution provide the instant transaction process that meets the demand of the modern financial transaction.

U.S. B2B Payments Transaction Market Companies

- American Express

- Bank of America Corporation

- MasterCard

- Citigroup Inc

- PayPal Holdings Inc

- Block Inc

- Payoneer Inc

Segments Covered in the Report

By Payment Type

- Domestic Payments

- Cross-border Payments

By Payment Mode

- Cheque And Cash

- Ach

- Card

- Wire And Others

By Enterprise Size

- Large Enterprises

- Smes

- Small Businesses

By Industry

- BFSI

- Manufacturing

- Businesses and Professional Services

- IT and Telecom

- Energy and Utilities

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/