Introduction

The U.S. Healthcare ERP (Enterprise Resource Planning) market is experiencing notable growth and transformation as healthcare organizations seek comprehensive solutions to streamline and optimize their operations. ERP systems tailored for the healthcare sector integrate various critical functions such as finance, supply chain, human resources, and patient management into a unified platform. This integration enhances efficiency, reduces operational costs, and improves overall patient care. In the dynamic landscape of U.S. healthcare, the adoption of ERP solutions is becoming increasingly pivotal for organizations aiming to enhance their organizational agility and adapt to evolving industry demands.

Get a Sample: https://www.precedenceresearch.com/sample/3731

Growth Factors:

Several factors contribute to the growth of the U.S. Healthcare ERP market. The escalating need for efficient data management and seamless communication across different departments within healthcare organizations is a primary driver. ERP systems facilitate real-time information sharing, enabling healthcare providers to make informed decisions promptly. The increasing focus on regulatory compliance and the demand for enhanced patient outcomes also drive the adoption of ERP solutions. Furthermore, the shift towards value-based care models encourages healthcare entities to invest in ERP systems to better manage resources, improve patient satisfaction, and optimize financial performance.

U.S. Healthcare ERP Market Scope

| Report Coverage |

Details |

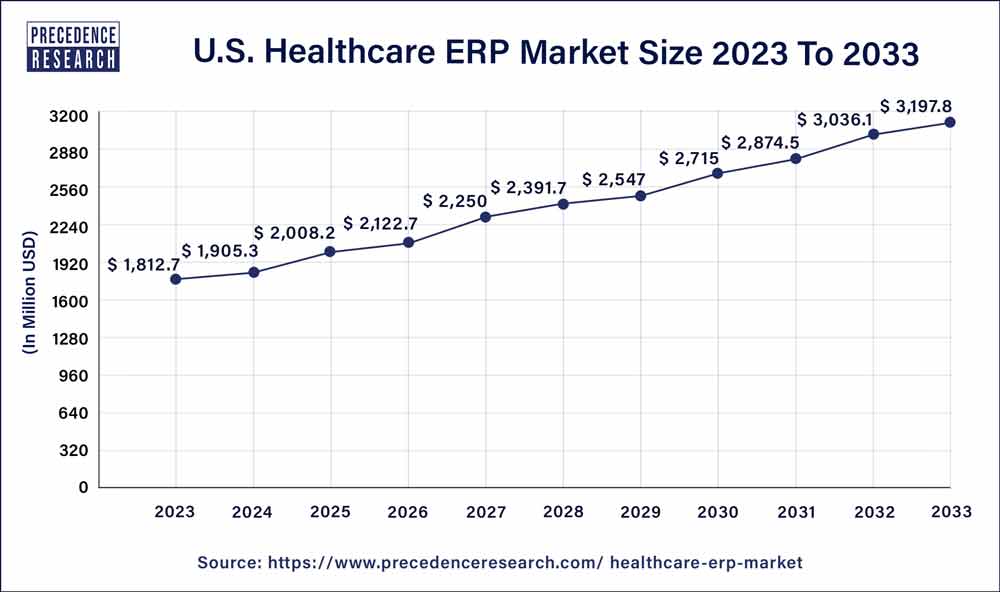

| Growth Rate from 2024 to 2033 |

CAGR of 5.92% |

| U.S. Market Size in 2023 |

USD 1,812.7 Million |

| U.S. Market Size by 2033 |

USD 3,197.8 Million |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Function, By Deployment, and By End User |

U.S. Healthcare ERP Market Dynamics

Drivers:

The drivers propelling the U.S. Healthcare ERP market are multifaceted. The rising complexity of healthcare operations necessitates advanced technological solutions to manage intricate processes efficiently. ERP systems offer a centralized platform for managing diverse aspects of healthcare operations, including billing, scheduling, and inventory management. Additionally, the need for interoperability and data exchange between different healthcare systems is a key driver, pushing organizations to adopt ERP solutions that can seamlessly integrate with existing technologies. The emphasis on data security and privacy compliance further accelerates the adoption of ERP systems, ensuring that patient information is handled securely and in compliance with regulatory standards.

Restraint:

Despite the growth prospects, certain challenges restrain the widespread adoption of ERP solutions in the U.S. healthcare sector. One significant restraint is the high initial investment required for implementing ERP systems. Healthcare organizations may face budget constraints and resistance to change, making it challenging to allocate resources for large-scale ERP deployments. Additionally, the complexity of integrating ERP systems with existing healthcare IT infrastructure and the potential disruption during the implementation process pose challenges. Overcoming these hurdles requires careful planning, stakeholder engagement, and a strategic approach to ensure a smooth transition to ERP-driven healthcare operations.

Opportunity:

The U.S. Healthcare ERP market presents significant opportunities for solution providers and healthcare organizations alike. The increasing demand for personalized and patient-centric care models creates opportunities for ERP systems to enhance the overall patient experience. As the healthcare industry continues to evolve, there is a growing need for analytics and business intelligence capabilities embedded within ERP solutions to derive actionable insights from vast amounts of healthcare data. Moreover, the ongoing digitization trends in healthcare, such as telehealth and remote patient monitoring, open doors for ERP systems to play a central role in integrating these technologies into cohesive and efficient healthcare workflows.

Region Snapshot

The U.S. Healthcare ERP market is geographically expansive, catering to the diverse needs of healthcare organizations across the nation. Different regions may exhibit varying levels of adoption based on factors such as local regulatory environments, the size and type of healthcare institutions, and regional healthcare priorities. Urban areas with large healthcare systems may adopt ERP solutions to manage complex operations, while rural regions may focus on ERP implementations to improve accessibility and patient care in underserved communities. The regional dynamics highlight the adaptability of Healthcare ERP systems to address diverse challenges and requirements within the U.S. healthcare landscape.

Read Also: Gear Pumps Market Size to Cross USD 12.8 Billion by 2033