Key Takeaways

- By hospital type, the public/community hospital segment held the largest market share of 53% in 2023.

- By service type, the outpatient services segment held the largest share of 52% in 2023.

- By service area, the cardiovascular segment held the largest share of 22% in 2023.

- By service area, the cancer care segment is expected to witness the fastest rate of growth during the forecast period of 2024-2033.

Introduction:

The U.S. Hospital Services Market is a dynamic sector within the healthcare industry that plays a crucial role in providing essential medical care and services to the population. With a vast network of hospitals ranging from small community facilities to large, specialized medical centers, this market segment is a critical component of the overall healthcare ecosystem in the United States. As a cornerstone of the nation’s healthcare infrastructure, U.S. hospitals collectively contribute significantly to the well-being of the population, addressing a wide array of medical needs and emergencies.

Get a Sample: https://www.precedenceresearch.com/sample/3708

Growth Factors:

Several key factors contribute to the growth of the U.S. Hospital Services Market. Technological advancements in medical treatments, diagnostic procedures, and healthcare management systems have propelled the sector forward. Additionally, an aging population with increased healthcare needs, coupled with a growing prevalence of chronic diseases, has stimulated demand for hospital services. The evolving landscape of healthcare policies and an emphasis on preventive care further contribute to the expansion of the U.S. Hospital Services Market.

U.S. Hospital Services Market Scope

| Report Coverage | Details |

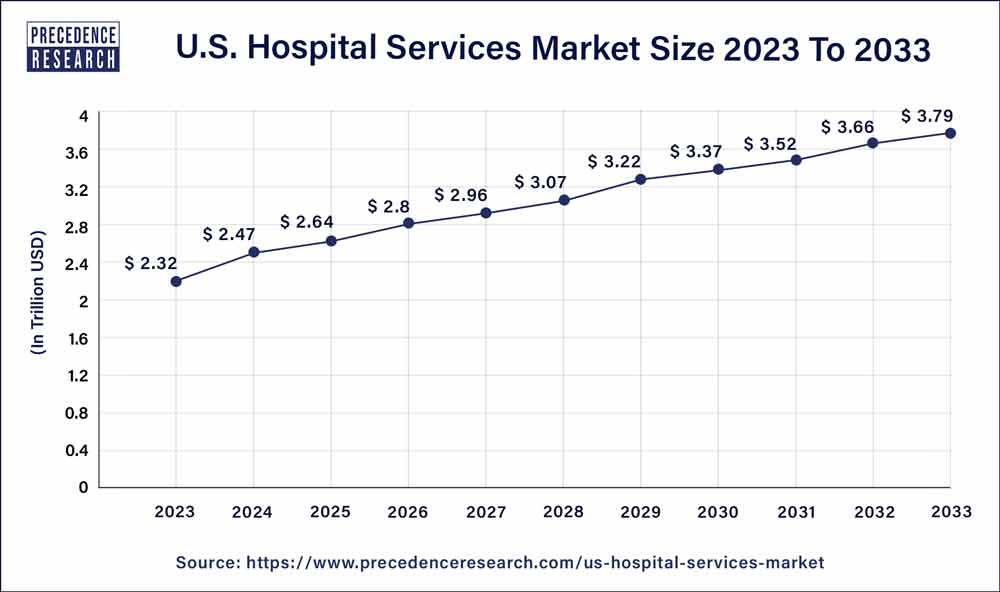

| U.S. Market Size in 2023 | USD 2.32 Trillion |

| U.S. Market Size by 2033 | USD 3.79 Trillion |

| Growth Rate from 2024 to 2033 | CAGR of 4.85% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Hospital Type, By Service Type, and By Service Areas |

U.S. Hospital Services Market Dynamics

Drivers:

The U.S. Hospital Services Market is driven by various factors that sustain its growth. One primary driver is the continuous innovation in medical technologies and treatment modalities, enhancing the capabilities of hospitals to diagnose and treat diverse medical conditions. Furthermore, the increasing awareness among the populace about the importance of regular health check-ups and early intervention has led to a surge in patient admissions. Collaborations between hospitals and healthcare technology companies also act as drivers, fostering advancements and improving overall patient care.

Restraints:

Despite its growth, the U.S. Hospital Services Market faces certain restraints. Financial challenges, including the high costs associated with maintaining state-of-the-art facilities and managing skilled healthcare professionals, pose a significant hurdle. Regulatory complexities and the administrative burden related to compliance with healthcare laws and regulations also create challenges for hospitals. Moreover, issues such as overburdened emergency departments and healthcare disparities contribute to the constraints faced by the sector.

Opportunities:

Amidst the challenges, there exist promising opportunities for the U.S. Hospital Services Market. The increasing focus on telehealth and remote patient monitoring presents a avenue for growth and efficiency. Collaborations between hospitals and technology companies, as well as partnerships with community health organizations, can enhance the reach and impact of hospital services. Investments in data analytics and artificial intelligence for healthcare management provide opportunities to optimize operations and improve patient outcomes. Additionally, the evolving landscape of value-based care models creates room for innovation and improved cost-effectiveness in the delivery of hospital services.

Read Also: Coenzyme Q10 Market Size to Reach Around USD 1,700.46 Million By 2033

Recent Developments

- In November 2023, to better serve patients, regulators, and healthcare professionals, AstraZeneca developed Evinova, which is poised to become a prominent supplier of digital health solutions. Evinova provides globally-scaled digital solutions and services to the life sciences and healthcare industry, with long-term support from AstraZeneca and key partnerships with Parexel and Fortrea.

- In March 2023, Health systems, providers, payers, and employer groups can now more effectively motivate and establish deep connections with patients virtually from anywhere with the launch of Philips Virtual Care Management, a comprehensive portfolio of flexible solutions and services from Royal Philips, a global leader in health technology. By lowering emergency room visits and improving the treatment of chronic diseases, Philips Virtual Care treatment can help reduce the burden on hospital staff and save healthcare costs.

U.S. Hospital Services Market Companies

- Mayo clinic

- HCA Healthcare

- Cleveland clinic

- Ascension Health

- Community Health Systems, Inc.

- Tenet Healthcare

- MIT Health

- Universal Health Services

- Trinity Health

- Lifepoint Health, Inc.

Segments Covered in the Report

By Hospital Type

- State-owned Hospital

- Private Hospital

- Public/ Community Hospital

By Service Type

- Outpatient Services

- Inpatient Service

By Service Areas

- Cardiovascular

- Acute Care

- Cancer Care

- Diagnostics, and Imaging

- Neurorehabilitation & Psychiatry Services

- Gynecology

- Others

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/