Table of Contents

ToggleKey Takeaways

- By product, the reagents segment dominated the market with the largest share of 67% in 2023.

- By test location, the point-of-care segment dominated the market in 2023.

- By technology, the Immunoassay segment is expected to dominate the market during the forecast period.

- By application, the infectious diseases segment led the market with the largest share in 2023.

- By application, the oncology segment is expected witness the fastest rate of growth during the forecast period of 2024-2033.

- By end user, the hospital segment held the dominating share of the market in 2023.

Introduction:

The U.S. In Vitro Diagnostics (IVD) market is a dynamic and crucial sector within the healthcare industry, playing a pivotal role in disease diagnosis and monitoring. In vitro diagnostics involve the use of medical devices, reagents, and systems to examine specimens such as blood or tissue outside the human body. With advancements in technology and an increasing focus on personalized medicine, the IVD market in the United States has witnessed substantial growth over the years. The sector encompasses a wide array of diagnostic tests, ranging from simple blood glucose tests to complex molecular diagnostics, contributing significantly to improved patient outcomes.

Get a Sample: https://www.precedenceresearch.com/sample/3712

Growth Factors:

Several factors contribute to the sustained growth of the U.S. IVD market. Technological advancements, particularly in areas such as molecular diagnostics, have expanded the capabilities of diagnostic tests, providing more accurate and timely results. The rising prevalence of chronic diseases, an aging population, and the increasing awareness and demand for early disease detection further fuel market growth. Additionally, the COVID-19 pandemic has underscored the importance of diagnostic testing, leading to increased investments in diagnostic infrastructure and research, thereby propelling the IVD market forward.

U.S. In Vitro Diagnostics Market Scope

| Report Coverage | Details |

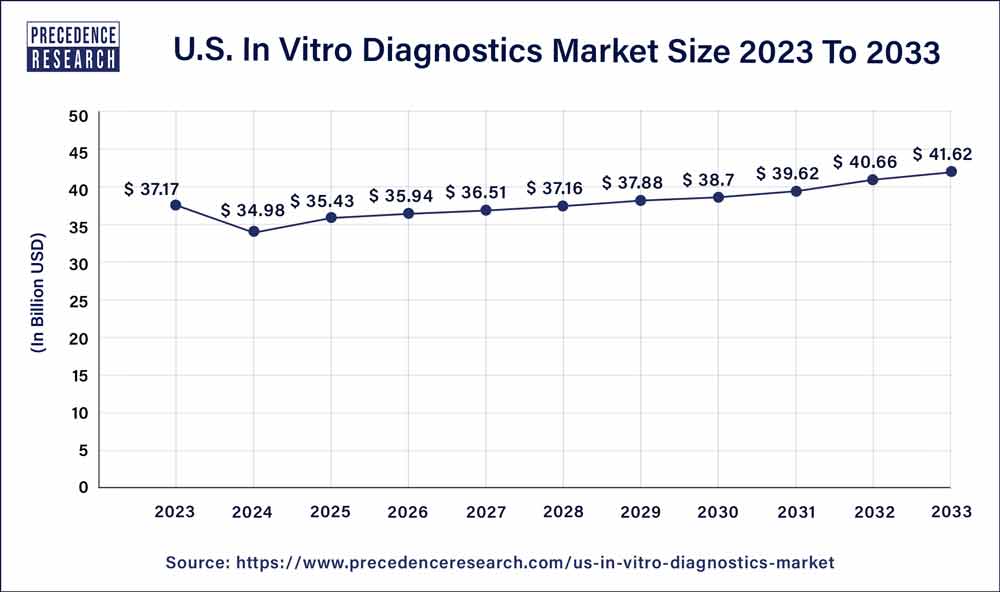

| U.S. Market Size in 2023 | USD 37.17 Billion |

| U.S. Market Size by 2033 | USD 41.62 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 2% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product, By Test Location, By Technology, By Application, and By End User |

U.S. In Vitro Diagnostics Market Dynamics

Drivers:

Key drivers of the U.S. IVD market include a strong emphasis on preventive healthcare, increased healthcare spending, and a growing trend towards companion diagnostics. The rise of point-of-care testing, enabling rapid and convenient diagnostic procedures, has also been a significant driver. Furthermore, the integration of artificial intelligence and data analytics into diagnostics enhances the accuracy and efficiency of results, contributing to the market’s positive momentum.

Restraints:

Despite its growth, the U.S. IVD market faces certain challenges. Regulatory complexities, reimbursement issues, and a stringent approval process for new diagnostic technologies can impede the market’s expansion. Additionally, economic downturns and budget constraints in healthcare spending may pose obstacles to the adoption of advanced diagnostic technologies, affecting market growth.

Opportunities:

Amidst challenges, the U.S. IVD market presents ample opportunities for innovation and expansion. The increasing adoption of personalized medicine, along with a focus on home-based diagnostics and telehealth, opens up new avenues. Collaborations between industry players and healthcare institutions, as well as strategic partnerships, can foster innovation and address the evolving needs of the healthcare landscape. Furthermore, ongoing research and development activities in the field of diagnostics promise breakthroughs that can reshape the market landscape and provide solutions to current limitations.

Read Also: Road Rollers Market Size to Surpass USD 6.97 Billion By 2033

Recent Developments

- In November 2023, to create molecular tests for decentralized in vitro diagnostic (IVD) applications, Illumina, a leader in DNA sequencing and array-based technologies, and Veracyte, a top genomic diagnostics business, have partnered for several years. The partnership is centered on using Illumina’s NextSeq 550Dx equipment to develop Veracyte’s Percepta Nasal Swab test and Prosigna Breast Cancer Assay.

- In March 2023, Eli Lilly & Company and Roche announced their partnership to promote the development of Roche’s Elecsys Amyloid Plasma Panel (EAPP). A novel blood test called the EAPP promises to help diagnose Alzheimer’s disease early.

- In April 2023, to enhance health outcomes worldwide, Oxford Nanopore Technologies and bioMérieux SA, a pioneer in the in vitro diagnostics industry, announced that they have joined forces to investigate specific prospects to introduce nanopore sequencing to the infectious disease diagnostics market.

U.S. In Vitro Diagnostics Market Companies

- Alere, Inc.

- Beckman Coulter

- BD

- Bio-Rad laboratories

- Danaher

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- bioMérieux, Inc

- Quest Diagnostics

- Illumina, Inc.

Segments Covered in the Report

By Product

- Reagents

- Instruments

- Services

By Test Location

- Point of Care

- Home Care

- Others

By Technology

- Immunoassay

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Instruments

- Reagents

- Services

By Application

- Diabetes

- Cardiology

- Nephrology

- Infectious Disease

- Oncology

- Drug Testing

- Autoimmune Diseases

- Others

By End User

- Standalone Laboratories

- Hospitals

- Academic & Medical Schools

- Point-of-Care

- Others

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/