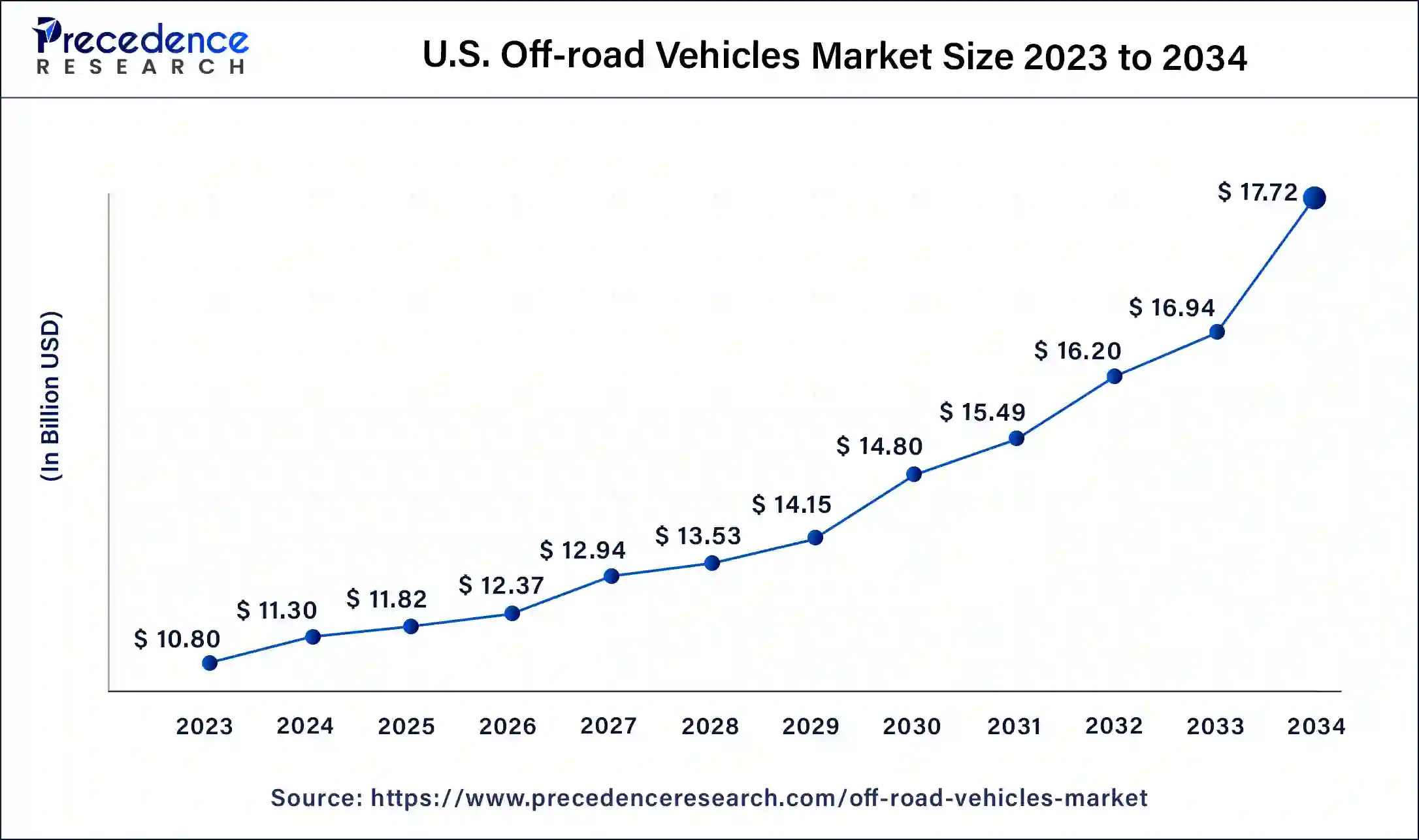

The U.S. off-road vehicles market size accounted for USD 12.63 billion in 2023 and is expected to attain around USD 19.09 billion by 2033, growing at a CAGR of 4.40% from 2024 to 2033.

Key Points

- By product type, the three-wheeler segment held the largest market share of 46% in 2023.

- By product type, the service segment is anticipated to grow at a remarkable CAGR of 8.4% between 2024 and 2033.

- By propulsion type, the diesel segment generated over 47% of market share in 2023.

- By propulsion type, the gasoline segment is expected to expand at the fastest CAGR over the projected period.

- By application, the sports segment generated over 38% of the market share in 2023.

- By application, the military segment is expected to expand at the fastest CAGR over the projected period.

The U.S. off-road vehicles market encompasses a range of vehicles designed for driving on unpaved terrains, such as all-terrain vehicles (ATVs), utility task vehicles (UTVs), and off-road motorcycles. These vehicles are commonly used for recreational purposes, such as trail riding and racing, as well as for work-related tasks in agriculture, construction, and other industries. The market has seen steady growth in recent years due to increased interest in outdoor activities and off-road sports.

U.S. Off-road Vehicles Market Data and Statistics

- In August 2022, Polaris introduced its latest flagship RZR Pro R Sport ATV model in India, boasting a robust 1997 cc 4-stroke DOHC inline four-cylinder engine that generates a formidable 225 bhp of maximum power.

- Also in 2022, Arctic Cat debuted the new Alterra 600 ATV, available in four distinct trim levels.

- In April 2021, Arctic Cat unveiled a new addition to its 2022 model year lineup, the Alterra 600 EPS, featuring a redesigned engine, drivetrain, and chassis, promising enhanced power, improved handling, and simplified servicing. Dealerships began stocking this model in July.

- February 2022 marked the entry of American Landmaster into the electric UTV market, offering electric-powered UTVs with a towing capacity of 1,200 lbs in both 2-door and 4-door configurations, operating in 4X2 driving mode.

- Also in February 2022, Segway Powersports expanded the availability of its Fugleman side-by-side vehicle to over 40 dealerships across the United States.

- Back in June 2020, Kawasaki unveiled its 2020 lineup of MULE and ATV vehicles, encompassing the Brute Force ATV series, MULE PRO lineup, and SX series.

Get a Sample: https://www.precedenceresearch.com/sample/4099

Growth Factors

Several factors contribute to the growth of the U.S. off-road vehicles market. These include rising disposable incomes, which allow consumers to spend more on recreational vehicles, and the growing popularity of outdoor adventures and off-roading activities. Additionally, technological advancements have led to improved vehicle performance, safety, and fuel efficiency, further driving demand for off-road vehicles.

Region Insights

The U.S. off-road vehicles market is widespread across different regions, with the Midwest and South being particularly strong markets due to their vast rural areas and outdoor recreational opportunities. States such as Texas, California, and Florida have a high demand for off-road vehicles because of their varied terrain and active off-roading communities.

U.S. Off-road Vehicles Market Scope

| Report Coverage | Details |

| U.S. Market Size in 2023 | USD 12.63 Billion |

| U.S. Market Size in 2024 | USD 13.16 Billion |

| U.S. Market Size by 2033 | USD 19.09 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.40% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Propulsion Type, and By Application |

U.S. Off-road Vehicles Market Dynamics

Drivers

Key drivers of the U.S. off-road vehicles market include increased interest in outdoor recreational activities and sports, as well as the use of off-road vehicles in various industries such as agriculture, forestry, and construction. The versatility and ruggedness of off-road vehicles make them suitable for a variety of tasks, contributing to their growing popularity.

Opportunities

Opportunities in the U.S. off-road vehicles market include the development of electric and hybrid off-road vehicles, which could appeal to environmentally conscious consumers. Additionally, there is potential for growth in aftermarket accessories and services, such as customization and maintenance, as more consumers seek to personalize their vehicles.

Challenges

The U.S. off-road vehicles market faces challenges such as fluctuating fuel prices, which can impact consumer purchasing decisions. Regulatory and environmental concerns also pose challenges, as some regions may impose restrictions on off-roading activities to protect wildlife habitats and natural landscapes. Additionally, competition from other recreational activities may impact market growth.

Read Also: Oral Rinse Market Size to Attain USD 13.70 Billion by 2033

Recent Developments

- In June 2023, Polaris Inc. revealed that it had secured a $700,000 grant aimed at facilitating the development of an electric vehicle (EV) charging infrastructure designed specifically for off-road vehicles. This initiative will be implemented within a public off-road trail system located in Michigan’s Upper Peninsula. The grant originates from the Mobility Public-Private Partnership & Programming (MP4) Grant, which is part of the Michigan Office of Future Mobility & Electrification’s efforts to strengthen the state’s mobility sector, including the outdoor recreation industry, through the adoption of electric and technologically enhanced vehicles.

- Also in June 2023, Kawasaki Motors Corp., U.S.A., announced the continuation of its partnership with TrueTimber. Commencing from the 2024 model year, TrueTimber will exclusively provide camouflage patterns for a range of Kawasaki models, including the newly introduced Kawasaki MULE PRO-FXT™ 1000.

U.S. Off-road Vehicles Market Companies

- Polaris Inc.

- Arctic Cat Inc.

- Yamaha Motor Corporation

- Honda Motor Co., Ltd.

- Kawasaki Motors Corp., U.S.A.

- Can-Am (BRP)

- Suzuki Motor Corporation

- John Deere

- Textron Inc.

- Kubota Corporation

- Kymco

- CFMOTO

- Mahindra & Mahindra Limited

- Massimo Motor

- American Landmaster

Segments Covered in the Report

By Product Type

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

By Propulsion Type

- Gasoline

- Diesel

- Electric

By Application

- Utility

- Sports

- Recreation

- Military

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/

Blog: https://www.dailytechbulletin.com/

Blog: https://www.autoindustrybulletin.com/