- By product type, the cough & cold products segment held the largest share of the market in 2023, the segment is observed to witness a notable growth during the forecast period.

- By dosage form, the tablets segment dominated the market with the largest share in 2023.

- By route of administration, the oral segment held the largest share of the market and is expected to sustain the position throughout the forecast period.

- By distribution channel, the drug stores & retail pharmacies segment dominated the U.S. over the counter (OTC) drugs market in 2023.

The U.S. Over the Counter (OTC) Drugs Market is a dynamic sector within the pharmaceutical industry, catering to the growing consumer demand for easily accessible and self-administrable healthcare solutions. Over-the-counter drugs are non-prescription medications available without a doctor’s prescription, allowing consumers to address various health concerns independently. The market has witnessed significant growth in recent years, driven by factors such as the increasing prevalence of minor ailments, rising healthcare awareness among consumers, and the convenience offered by OTC drugs.

Get a Sample: https://www.precedenceresearch.com/sample/3753

Growth Factors

Several factors contribute to the robust growth of the U.S. OTC Drugs Market. One key driver is the changing consumer perception of self-care, as individuals increasingly seek quick and convenient solutions for common health issues. Moreover, the expanding aging population in the U.S. has led to a higher incidence of health problems, further boosting the demand for OTC medications. Additionally, the proactive efforts of pharmaceutical companies to innovate and introduce new OTC products, coupled with extensive marketing strategies, contribute to market expansion.

U.S. Over the Counter (OTC) Drugs Market Scope

| Report Coverage | Details |

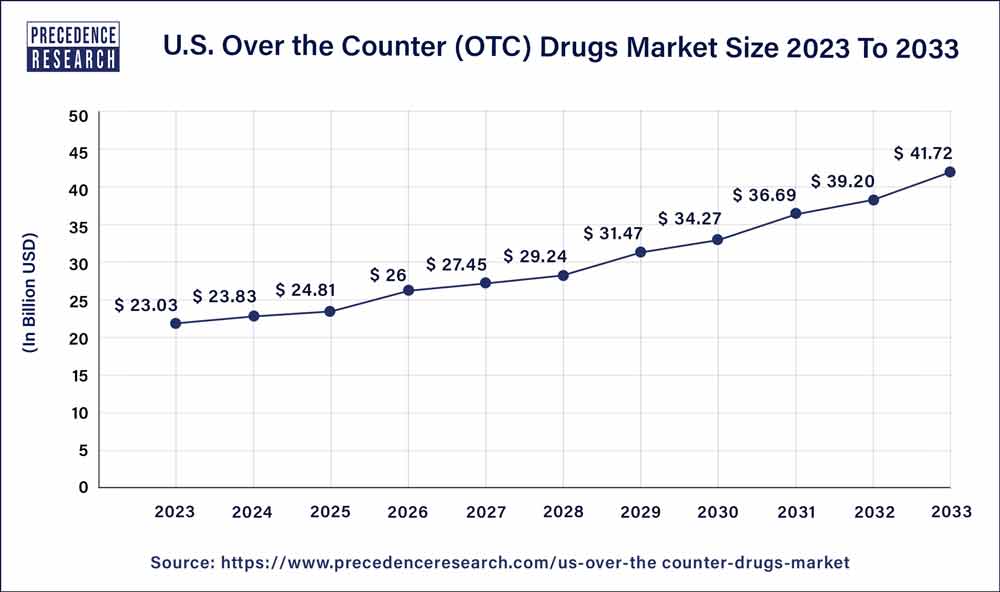

| Growth Rate from 2024 to 2033 | CAGR of 6.42% |

| U.S. Market Size in 2023 | USD 23.03 Billion |

| U.S. Market Size by 2033 | USD 41.72 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Dosage Form, By Route of Administration, and By Distribution Channel |

Recent Developments

- In July 2023, a leading manufacturer of consumer self-care products Perrigo Company plc announced that Opill®, a daily oral contraceptive that solely contains progestin, has been authorized by the FDA for use by people of all ages as an over-the-counter (OTC) medication. The first birth control pill to be sold over-the-counter in the US was called Opill.

- In June 2023, Foster & Thrive, a carefully chosen private brand of over-the-counter (OTC) health and wellness products, was recently introduced by McKesson Corporation MCK. The launch will include OTC items bearing the Health Mart and Sunmark brands, to unify the company’s private brand portfolio.

U.S. Over the Counter (OTC) Drugs Market Dynamics

Drivers

The market is propelled by various drivers, including the ease of access and affordability of OTC drugs compared to prescription medications. Consumers appreciate the ability to purchase medications directly without the need for a doctor’s visit, leading to time and cost savings. Furthermore, the OTC drugs market benefits from the increasing trend of e-commerce in the healthcare sector, providing consumers with the convenience of ordering medications online and having them delivered to their doorstep.

Restraints

Despite its significant growth, the U.S. OTC Drugs Market faces certain challenges. One notable restraint is the potential for misuse or overuse of OTC medications, leading to adverse effects. The lack of direct supervision by healthcare professionals can result in individuals not following proper dosage instructions, which may have health implications. Regulatory concerns regarding the safety of certain OTC drugs also pose challenges, prompting authorities to monitor and evaluate the market closely.

Opportunities

The U.S. OTC Drugs Market presents ample opportunities for further expansion. The ongoing trend of consumer empowerment in healthcare decisions creates a favorable environment for OTC drugs. Manufacturers can capitalize on this trend by developing innovative and effective OTC products that address emerging health concerns. Collaboration between pharmaceutical companies and healthcare providers can enhance educational initiatives, ensuring consumers make informed choices when selecting OTC medications. Moreover, the integration of advanced technologies, such as telemedicine and mobile health apps, offers new avenues for reaching and assisting consumers in their self-care journey.

Read Also: Artificial Intelligence Engineering Market Size To Cross Report by 2033

Key Market Players

- Bayer AG

- Takeda Pharmaceutical Company Ltd.

- Pfizer

- Johnson & Johnson Services Inc.

- Sanofi S.A.

- Novartis AG

- Boehringer Ingelheim International GmbH

- GlaxoSmithKline PLC

- Mylan

- UPM Pharmaceuticals

Segments Covered in the Report

By Product Type

- Vitamin and Dietary Supplements

- Cough & Cold Products

- Analgesics

- Gastrointestinal Products

- Sleep Aids

- Otic Products

- Wart Removers

- Mouth Care Products

- Ophthalmic Products

- Botanicals

- Antacids

- Smoking Cessation Products

- Feminine Care

- Others

By Dosage Form

- Tablets

- Hard Capsules

- Powders

- Ointments

- Soft Capsules

- Liquids

- Others

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/