- By drug class, the opioids segment is expected to dominate the market over the forecast period.

- By indication, the arthritic pain segment is expected to capture the largest market share during the forecast period.

- By distribution channel, the hospital pharmacy segment held the largest share of the market in 2023. The segment is observed to sustain the position throughout the predicted timeframe.

The US Pain Management Drugs market is a critical segment within the broader pharmaceutical industry, playing a pivotal role in addressing the growing prevalence of chronic pain conditions. This overview explores the key aspects of the market, including current trends, growth factors, drivers, opportunities, and challenges that shape the landscape of pain management pharmaceuticals in the United States.

Get a Sample: https://www.precedenceresearch.com/sample/3839

Growth Factors

One of the primary growth factors in the US Pain Management Drugs market is ongoing research and development. Pharmaceutical companies are investing in the discovery and development of novel analgesic compounds with improved efficacy and safety profiles. Advancements in understanding the neurobiology of pain have led to the identification of new drug targets, fostering innovation in the field.

Additionally, the increasing awareness and recognition of pain management as a crucial aspect of patient care contribute to market growth. Healthcare professionals are emphasizing the importance of personalized treatment plans that include pharmacological interventions tailored to the specific nature of the pain, promoting the adoption of pain management drugs.

US Pain Management Drugs Market Scope

| Report Coverage | Details |

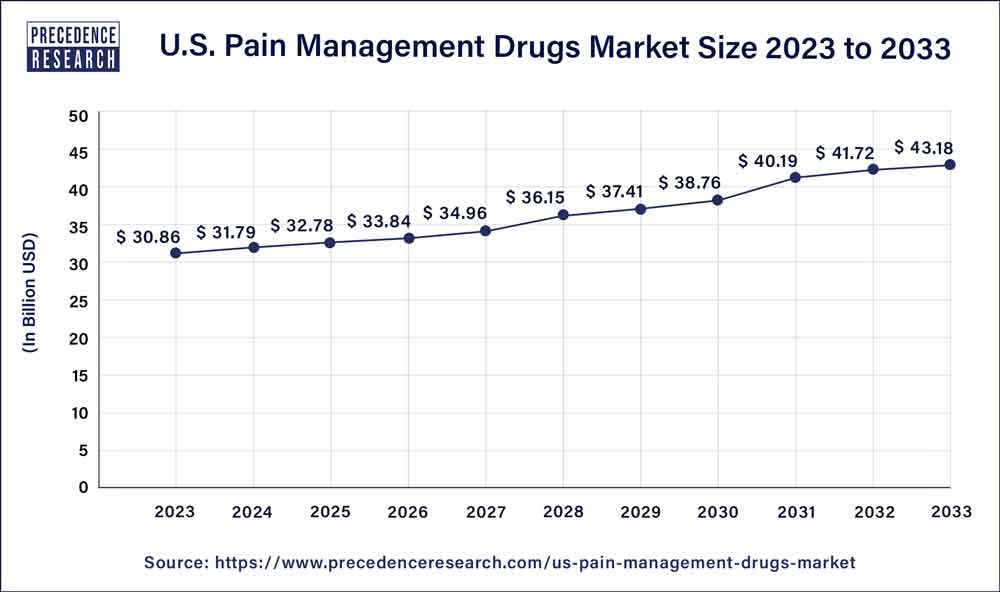

| U.S. Market Size in 2023 | USD 30.86 Billion |

| U.S. Market Size by 2033 | USD 43.18 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 3.46% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Drug Class, By Indication, and By Distribution Channel |

Market Dynamics

The demand for pain management drugs in the US is driven by several factors. The aging population, coupled with a rising incidence of chronic diseases, contributes significantly to the prevalence of chronic pain. Conditions such as arthritis, neuropathic pain, and musculoskeletal disorders have become increasingly common, necessitating effective pharmacological interventions.

Drivers:

The opioid epidemic has prompted a shift in the prescribing patterns for pain management drugs. Healthcare providers are increasingly cautious about opioid prescriptions, leading to the exploration of alternative analgesic options. Non-opioid pain medications, including nonsteroidal anti-inflammatory drugs (NSAIDs), anticonvulsants, and antidepressants, are gaining prominence as safer alternatives, thereby driving market expansion.

Moreover, the integration of technology in pain management, such as wearable devices and telemedicine, is a significant driver. These technologies not only enhance patient monitoring but also facilitate remote consultations, enabling a more comprehensive and accessible approach to pain management.

Opportunities:

The US Pain Management Drugs market presents opportunities for pharmaceutical companies to develop and market innovative formulations. Extended-release formulations, abuse-deterrent formulations, and combination therapies that target multiple pain pathways are areas of active exploration. Additionally, the increasing focus on precision medicine opens avenues for the development of personalized pain management approaches based on genetic and molecular factors.

Furthermore, the growing emphasis on holistic and multimodal pain management approaches creates opportunities for the integration of pharmaceuticals with complementary therapies such as physical therapy, acupuncture, and cognitive-behavioral therapy. Collaborations between pharmaceutical companies and other healthcare stakeholders can capitalize on these opportunities, providing more comprehensive solutions for patients.

Challenges:

Despite the growth prospects, the US Pain Management Drugs market faces challenges. Stringent regulatory requirements and the need for extensive clinical testing pose hurdles for the timely approval of new pain management drugs. Additionally, concerns about the potential side effects of certain pain medications and the risk of dependence contribute to the cautious approach in drug development and prescribing practices.

The economic burden of chronic pain management is another challenge. High healthcare costs associated with pain treatment, coupled with reimbursement challenges, can limit patient access to advanced and effective pain management drugs. Addressing these challenges requires a collaborative effort involving pharmaceutical companies, healthcare providers, and policymakers.

Read Also: Virtual Sports Market Size Rake USD 77.07 Billion by 2033

Recent Developments

- In May 2023, Zoetis Inc. announced that LibrelaTM (bedinvetmab injectable) has been authorized by the U.S. Food and Drug Administration (FDA) for the management of pain in dogs suffering from osteoarthritis (OA). The first and only monthly anti-NGF monoclonal antibody medication for canine OA pain is called Librela, and it is both safe and effective in managing dogs’ OA pain symptoms over the long term, which can enhance their mobility and general quality of life.

US Pain Management Drugs Market Companies

- Teva Pharmaceutical

- Pfizer

- Abbott

- Mallinckrodt Pharmaceuticals

- Endo International

- GlaxoSmithKline

- AstraZeneca

- Depomed

- Merck

- Novartis

Segments Covered in the Report

By Drug Class

- NSAIDs

- Opioids

- Anesthetics

- Antidepressants

- Anticonvulsants

- Others

By Indication

- Arthritic Pain

- Neuropathic Pain

- Chronic Back Pain

- Post-Operative Pain

- Cancer Pain

- Others

By Distribution Channel

- Online Pharmacy

- Retail Pharmacy

- Hospital Pharmacy

Contact Us:

Mr. Alex

Sales Manager

Call: +1 9197 992 333

Email: sales@precedenceresearch.com

Web: https://www.precedenceresearch.com

Blog: https://www.expresswebwire.com/

Blog: https://www.uswebwire.com/