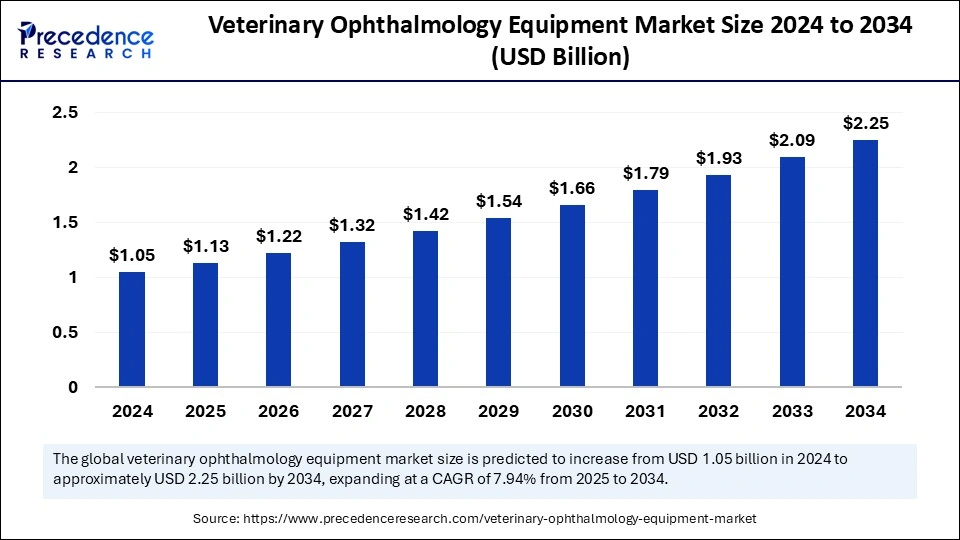

The global veterinary ophthalmology equipment market size expected to hit USD 2.25 billion by 2034, growing at a CAGR of 7.94% from 2024.

Veterinary Ophthalmology Equipment Market Key Takeaways

-

North America captured the largest market share of 41% in 2024, while Asia Pacific is projected to grow at the highest CAGR of 8.05% during the forecast period.

-

The diagnosis equipment segment led the market by equipment type in 2024, with treatment equipment expected to grow at the fastest rate in the coming years.

-

Diagnosis of ocular diseases was the leading application in 2024, while routine eye examinations are forecasted to witness rapid growth during the projection period.

-

Among animal types, the dogs segment dominated the market in 2024.

-

Optical coherence tomography (OCT) emerged as the leading technology segment in 2024, with digital imaging systems anticipated to experience the highest growth rate in the near future.

-

Veterinary clinics remained the dominant end-user segment in 2024.

Veterinary Ophthalmology Equipment Market Overview

The veterinary ophthalmology equipment market is experiencing significant growth due to increasing awareness of animal eye health and advancements in diagnostic and therapeutic technologies. Veterinary ophthalmology involves the diagnosis and treatment of eye diseases in animals, including companion animals, livestock, and exotic species.

The market encompasses a range of equipment such as slit lamps, tonometers, ophthalmoscopes, and surgical instruments used for diagnosing and treating ocular disorders. With the rising incidence of eye conditions such as glaucoma, cataracts, and corneal injuries, the demand for specialized ophthalmic procedures is increasing.

Veterinary Ophthalmology Equipment Market Drivers

The rising prevalence of ocular diseases in companion animals is a primary driver of market growth. Pet owners are increasingly seeking specialized ophthalmic care for their animals, leading to higher demand for diagnostic and surgical equipment. The growing adoption of advanced imaging technologies such as optical coherence tomography (OCT) and fundus photography is enhancing the accuracy and efficiency of ophthalmic diagnostics, contributing to market expansion. Technological innovations, such as minimally invasive surgical procedures and AI-based diagnostic tools, are further boosting market growth.

Additionally, the increasing number of veterinary ophthalmologists and specialized clinics is improving access to quality eye care for animals, driving the adoption of advanced ophthalmic equipment.

Veterinary Ophthalmology Equipment Market Opportunities

The veterinary ophthalmology equipment market presents significant opportunities for growth, particularly in emerging markets. Countries in Asia Pacific and Latin America are witnessing increased pet ownership and improving veterinary healthcare infrastructure, creating a conducive environment for market expansion. The integration of AI and machine learning in ophthalmic diagnostics is offering new possibilities for enhancing diagnostic accuracy and treatment outcomes.

Portable and user-friendly ophthalmic devices are making it easier for veterinarians to perform diagnostics in remote and mobile settings, further expanding market reach. Collaborations between veterinary institutions, research organizations, and equipment manufacturers are fostering innovation and driving the development of advanced ophthalmic solutions.

Veterinary Ophthalmology Equipment Market Challenges

Despite the positive outlook, the veterinary ophthalmology equipment market faces challenges that may hinder growth. The high cost of advanced ophthalmic devices limits their adoption, especially in low- and middle-income regions. Small and mid-sized veterinary clinics often struggle to invest in sophisticated diagnostic and surgical equipment due to budget constraints.

Moreover, the shortage of trained veterinary ophthalmologists capable of performing complex eye surgeries and operating advanced equipment remains a significant barrier. Regulatory challenges associated with the approval of veterinary ophthalmic devices and the lack of standardization in diagnostic protocols may also impede market growth. Limited awareness about the availability of specialized ophthalmic care for animals in rural and underserved areas further restricts market potential.

Regional Insights

North America is the largest market for veterinary ophthalmology equipment, driven by a well-established veterinary healthcare system, a high rate of pet adoption, and increasing awareness about animal eye health. The United States, in particular, accounts for a significant share of the market, owing to the presence of numerous veterinary specialists and advanced diagnostic facilities.

Europe follows closely, with countries such as Germany, the United Kingdom, and France leading the region’s growth. Asia Pacific is expected to experience the highest growth rate due to rising disposable income, increasing pet ownership, and improving veterinary healthcare infrastructure. Latin America and the Middle East & Africa are also emerging markets with considerable growth potential, fueled by rising investments in veterinary healthcare and the presence of global veterinary equipment manufacturers.

Recent Developments

Recent developments in the veterinary ophthalmology equipment market highlight the increasing adoption of advanced diagnostic and therapeutic technologies. Leading market players are focusing on developing AI-powered diagnostic tools to enhance the accuracy and speed of ophthalmic diagnosis. The introduction of portable and minimally invasive devices is improving accessibility to quality eye care for animals. Strategic collaborations and partnerships between veterinary hospitals, research institutions, and equipment manufacturers are fostering innovation and expanding the application of advanced ophthalmic technologies.

Additionally, companies are expanding their product portfolios to include specialized surgical instruments and therapeutic devices, catering to the evolving needs of the veterinary community.

Veterinary Ophthalmology Equipment Market Companies

- Bausch + Lomb Corporation

- Revenio Group Oyj

- Halma Plc (Keeler, a wholly owned subsidiary of Halma Plc)

- Baxter International, Inc. (Hill-Rom, a wholly owned subsidiary of Baxter International, Inc.)

- AMETEK, Inc.

- Alten Group

- Accenture

- Consonance

- Althea Group

- MED INSTITUTE

- Saraca Solutions Private Limited

- Nemedio Inc.

Sternum - Medcrypt

- MCRA, LLC

- North American Science Associates, LLC

- MedQtech

Segments Covered in the Report

By Equipment Type

- Diagnosis Equipment

- Surgical Equipment

- Treatment Equipment

- Vision Assessment Equipment

- Instruments for Eye Examination

By Application

- Diagnosis of Ocular Diseases

- Routine Eye Examinations

- Surgical Procedures for Eye Disorders

- Emergency Eye Care

- Vision Rehabilitation

By Animal Type

- Dogs

- Cats

- Horses

- Exotic Animals

- Farm Animals

By Technology

- Optical Coherence Tomography (OCT)

- Digital Imaging Systems

- Fluorescein Angiography

- Ultrasound Imaging

- Electroretinography (ERG)

By End-user

- Animal hospitals

- Veterinary Clinics

- Research Institutions

- Veterinary Universities

- Mobile Veterinary Services

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa (MEA)

Ready for more? Dive into the full experience on our website!