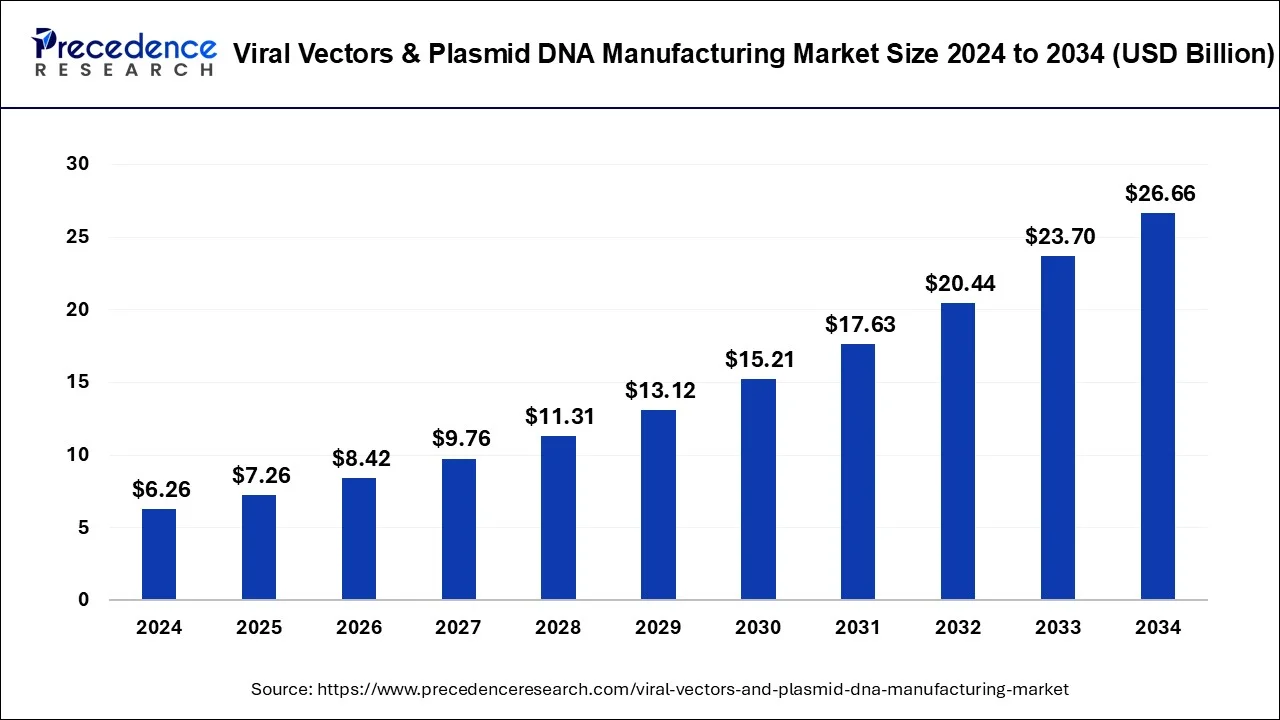

The global viral vectors & plasmid DNA manufacturing market was valued at USD 6.26 billion in 2024 and is projected to reach USD 26.66 billion by 2034, growing at a CAGR of 15.59%.

Viral Vectors & Plasmid DNA Manufacturing Market Key Takeaways

- North America led the viral vectors & plasmid DNA manufacturing market with a 49% revenue share in 2024.

- The AAV segment accounted for 21% of total market revenue in 2024, showing strong growth in the vector type category.

- Downstream processing dominated the workflow segment with a 54% revenue share in 2023.

- The vaccinology segment held the largest application share at 22.5% in 2024.

- Cancer remained the leading disease segment, contributing 38% of total market revenue in 2024.

- Research institutes emerged as the dominant end-use segment, capturing 58.4% of market revenue in 2024.

Overview

The viral vectors and plasmid DNA manufacturing market is experiencing significant growth due to the increasing demand for gene therapies, vaccines, and cell-based research. Viral vectors and plasmid DNA play a crucial role in gene transfer, facilitating the development of innovative treatments for genetic disorders, cancers, and infectious diseases. The rapid advancements in biotechnology, along with the expanding pipeline of gene therapies and personalized medicine, are driving the need for large-scale and high-quality production of these genetic materials. As biopharmaceutical companies and research institutions focus on developing advanced therapeutics, the market for viral vectors and plasmid DNA manufacturing is poised for substantial expansion in the coming years.

Market Drivers

Several factors are fueling the growth of the viral vectors and plasmid DNA manufacturing market. The rising prevalence of genetic and chronic diseases has intensified the demand for gene therapies and advanced biologics, requiring efficient manufacturing processes. The COVID-19 pandemic highlighted the importance of viral vector-based vaccines, accelerating research and development efforts in this field. Additionally, the increasing number of clinical trials focused on cell and gene therapies has created a strong demand for viral vector and plasmid DNA production. Government initiatives and funding support for gene therapy research, along with technological advancements in bioprocessing and manufacturing scalability, are further propelling market growth.

Opportunities in the Market

The market presents numerous opportunities, particularly in the expansion of contract development and manufacturing organizations (CDMOs) that provide scalable and cost-effective manufacturing solutions. As demand for viral vectors and plasmid DNA grows, companies specializing in large-scale production and process optimization are gaining traction. The emergence of non-viral delivery systems and advancements in synthetic biology offer additional avenues for innovation. Moreover, the increasing collaborations between biopharmaceutical companies, research institutions, and regulatory bodies are fostering advancements in manufacturing technologies, ensuring the efficient production of high-quality gene therapy products.

Challenges Facing the Market

Despite its growth potential, the viral vectors and plasmid DNA manufacturing market faces several challenges. High production costs and complex manufacturing processes pose significant barriers to market expansion. The stringent regulatory requirements for gene therapy products necessitate rigorous quality control measures, which can slow down production timelines and increase operational costs. Additionally, the limited availability of skilled professionals in bioprocessing and gene therapy manufacturing creates workforce challenges for companies. The scalability of manufacturing processes remains a critical issue, as demand for gene therapies continues to rise, requiring enhanced production capabilities and infrastructure investments.

Regional Insights

The market for viral vectors and plasmid DNA manufacturing exhibits strong growth across various regions. North America dominates the market, driven by a well-established biotechnology sector, extensive research and development activities, and strong government support for gene therapy innovations. The United States, in particular, leads in clinical trials and regulatory approvals for gene-based treatments. Europe is also a significant player, with countries such as Germany, the United Kingdom, and France investing heavily in biopharmaceutical research and manufacturing. The Asia-Pacific region is emerging as a lucrative market due to increasing biopharmaceutical investments, expanding healthcare infrastructure, and a growing number of biotechnology startups in countries like China, Japan, and South Korea. Meanwhile, Latin America and the Middle East are gradually entering the market, with rising interest in advanced therapeutics and vaccine development.

Recent Developments

The viral vectors and plasmid DNA manufacturing market has seen several notable advancements in recent months. Biopharmaceutical companies are expanding their manufacturing facilities to meet the growing demand for gene therapy products. Investments in automation and next-generation bioprocessing technologies are enhancing production efficiency and scalability. Several industry players have announced partnerships and acquisitions to strengthen their capabilities in viral vector production and gene therapy manufacturing. Additionally, regulatory agencies are working on streamlining approval processes to accelerate the commercialization of gene-based treatments. As research in genetic medicine continues to evolve, the market is expected to witness continuous innovation and expansion in the coming years.

Viral Vectors & Plasmid DNA Manufacturing Market Companies

- Novasep

- Aldevron

- MerckWaismanBiomanufacturing

- Creative Biogene

- The Cell and Gene Therapy Catapult

- Cobra Biologics

- uniQure N.V.

Segment Covered In The Report

By Vector Type

- Adenovirus

- Plasmid DNA

- Lentivirus

- Retrovirus

- AAV

- Others

By Application

- Gene Therapy

- Antisense &RNAi

- Cell Therapy

- Vaccinology

By Workflow

- Upstream Processing

- Vector Recovery/Harvesting

- Vector Amplification & Expansion

- Downstream Processing

- Fill-finish

- Purification

By End-User

- Biopharmaceutical and Pharmaceutical Companies

- Research Institutes

By Disease

- Genetic Disorders

- Cancer

- Infectious Diseases

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of the World

Ready for more? Dive into the full experience on our website!

https://www.precedenceresearch.com/